The Role of Data Analytics in Banking: How Insights Drive Decision-Making

[ad_1]

The Role of Data Analytics in Banking: How Insights Drive Decision-Making

The banking industry has undergone a significant transformation in recent years, driven by technological advancements, changing customer behavior, and increasing competition. One of the key drivers of this transformation is the use of data analytics, which has become a crucial tool for banks to stay ahead of the curve and make informed decisions. In this article, we’ll explore the role of data analytics in banking and how it helps drive decision-making.

The Challenges of Banking

The banking industry is known for its complexity, with multiple products, services, and channels to manage. This complexity creates a rich environment for data to be generated, with a vast amount of information available about customer behavior, transactions, and market trends. However, without the right tools and analytics, banks struggle to extract valuable insights from this data, leading to missed opportunities and poor decision-making.

The Benefits of Data Analytics

Data analytics in banking offers numerous benefits, including:

- Improved Customer Insights: By analyzing customer data, banks can gain a deeper understanding of their needs, preferences, and behaviors. This insights can be used to develop targeted marketing campaigns, personalized products, and improved customer service.

- Enhanced Risk Management: Data analytics helps banks identify and manage risks more effectively, by analyzing large volumes of data to identify patterns and anomalies. This includes identifying potential fraud, assessing credit risk, and monitoring market volatility.

- Optimized Operations: Data analytics can help banks optimize their operations, by identifying areas of inefficiency, reducing costs, and improving process efficiency.

- Competitive Advantage: By leveraging data analytics, banks can gain a competitive advantage, by identifying new opportunities, developing innovative products, and improving customer satisfaction.

How Data Analytics Drives Decision-Making

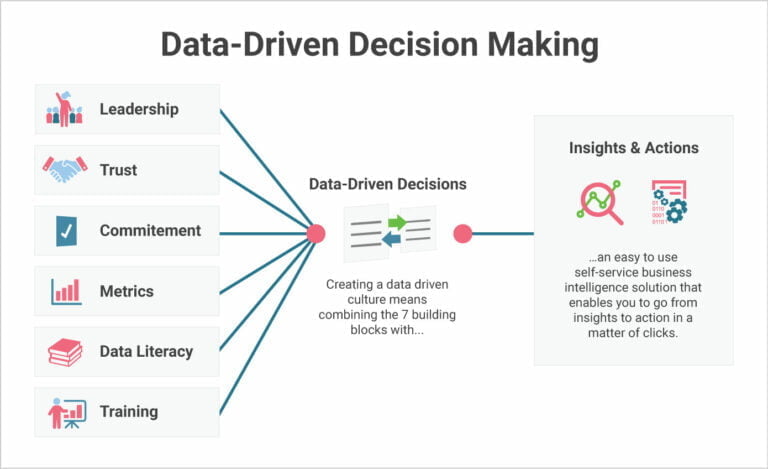

Data analytics plays a critical role in driving decision-making in banking, by providing insights that inform strategic decisions. Here are some ways data analytics drives decision-making:

- Risk-Based Decision-Making: Data analytics helps banks make risk-based decisions, by analyzing large volumes of data to identify potential risks and opportunities.

- Customer Segmentation: By analyzing customer data, banks can segment their customers, identifying high-value customers, and developing targeted marketing campaigns.

- Product Development: Data analytics helps banks develop new products and services, by identifying gaps in the market, and understanding customer needs.

- Portfolio Optimization: Data analytics helps banks optimize their portfolio, by analyzing large volumes of data to identify the most profitable assets, and reducing exposure to risk.

Best Practices for Implementing Data Analytics

Implementing data analytics in banking requires careful planning and execution. Here are some best practices to follow:

- Define Clear Objectives: Clearly define the objectives of the data analytics project, and ensure that everyone involved is aligned with the goals.

- Integrate Data Sources: Integrate multiple data sources, including customer data, transactional data, and market data, to gain a complete view of the business.

- Select the Right Tools: Select the right data analytics tools, including machine learning algorithms, statistical models, and data visualization software.

- Train Staff: Train staff on data analytics, including data interpretation, visualization, and storytelling.

Conclusion

Data analytics is a critical tool for banks to stay ahead of the curve and make informed decisions. By leveraging data analytics, banks can gain a deeper understanding of their customers, manage risk more effectively, optimize operations, and gain a competitive advantage. By following best practices and implementing data analytics effectively, banks can unlock the full potential of their data and drive growth and profitability.

[ad_2]