Whole Life Insurance vs. Universal Life Insurance: Which is Best?

[ad_1]

Whole Life Insurance vs. Universal Life Insurance: Which is Best?

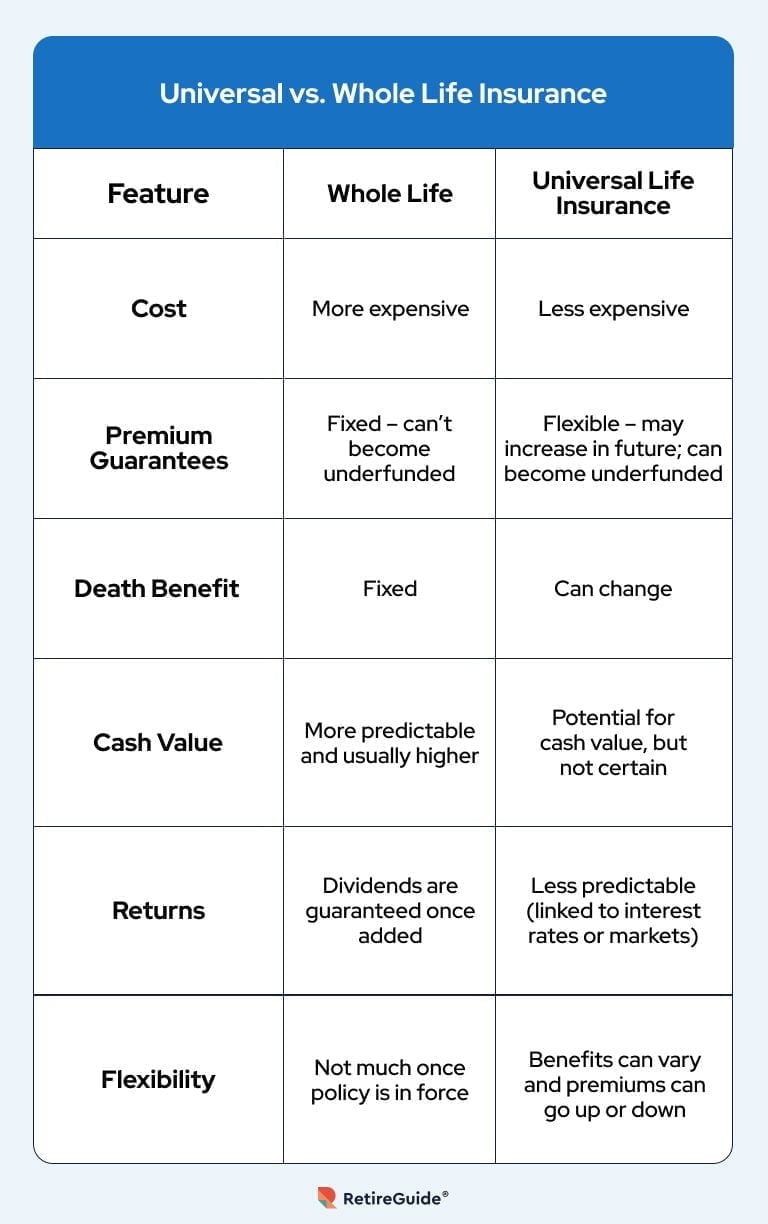

When it comes to purchasing life insurance, there are many options to choose from, each with its own set of features and benefits. Two of the most popular types of life insurance are whole life insurance and universal life insurance. Both offer a death benefit and a cash value component, but they differ in their structure, flexibility, and potential for growth. In this article, we’ll explore the key differences between whole life insurance and universal life insurance, helping you make an informed decision about which type of policy is best for you.

Whole Life Insurance

Whole life insurance, also known as traditional life insurance, provides a death benefit and a cash value component. The cash value grows at a fixed rate, usually tied to the interest rate of a savings account. Whole life insurance policies typically have a fixed premium, which remains the same throughout the life of the policy. The policyholder pays the premium, and in return, the insurance company pays a death benefit to the beneficiary when the policyholder passes away.

Pros of Whole Life Insurance:

- Predictable premiums: Whole life insurance premiums remain the same throughout the life of the policy, making it easier to budget.

- Guaranteed cash value: The cash value grows at a fixed rate, providing a guaranteed return on investment.

- Tax-deferred growth: The cash value grows tax-deferred, meaning you won’t have to pay taxes on the gains until you withdraw them.

- Lifetime coverage: Whole life insurance provides coverage for the policyholder’s entire lifetime, as long as premiums are paid.

Cons of Whole Life Insurance:

- Limited flexibility: Whole life insurance policies are inflexible, meaning you can’t adjust the premium or death benefit.

- Low returns: The cash value growth rate is typically lower than other investment options.

- High fees: Whole life insurance policies often come with higher fees, which can eat into the cash value.

Universal Life Insurance

Universal life insurance is a flexible premium policy that combines a death benefit with a cash value component. The cash value grows at a variable rate, tied to the performance of an investment portfolio. Universal life insurance policies allow policyholders to adjust their premiums, death benefit, and investment options, making them more flexible than whole life insurance.

Pros of Universal Life Insurance:

- Flexibility: Universal life insurance policies allow policyholders to adjust their premiums, death benefit, and investment options.

- Potential for higher returns: The cash value can grow at a higher rate than whole life insurance, as it’s tied to the performance of an investment portfolio.

- Tax-deferred growth: The cash value grows tax-deferred, just like whole life insurance.

- Customization: Universal life insurance policies can be tailored to meet individual needs and goals.

Cons of Universal Life Insurance:

- Variable returns: The cash value growth rate is tied to the performance of an investment portfolio, which can be volatile.

- Higher fees: Universal life insurance policies often come with higher fees, which can eat into the cash value.

- Risk of surrender charges: If you surrender the policy, you may face surrender charges, which can reduce the cash value.

Which is Best?

The choice between whole life insurance and universal life insurance ultimately depends on your individual circumstances, financial goals, and risk tolerance. If you:

- Value predictability and guaranteed returns, whole life insurance may be the better choice.

- Are looking for flexibility and the potential for higher returns, universal life insurance may be the better choice.

- Are seeking a low-cost, simple policy, whole life insurance may be the better choice.

- Are willing to take on more risk and invest in a variable portfolio, universal life insurance may be the better choice.

In conclusion, both whole life insurance and universal life insurance offer a death benefit and a cash value component, but they differ in their structure, flexibility, and potential for growth. By understanding the pros and cons of each type of policy, you can make an informed decision about which type of policy is best for you.

[ad_2]