The Pros and Cons of Indexed Universal Life Insurance

[ad_1]

The Pros and Cons of Indexed Universal Life Insurance

Indexed Universal Life (IUL) insurance is a type of permanent life insurance that combines a death benefit with a savings component that is linked to the performance of a specific stock market index, such as the S&P 500. IUL policies have gained popularity in recent years due to their flexibility and potential for tax-free growth. However, like any insurance product, IUL policies also have their pros and cons. In this article, we will explore the advantages and disadvantages of Indexed Universal Life Insurance to help you make an informed decision.

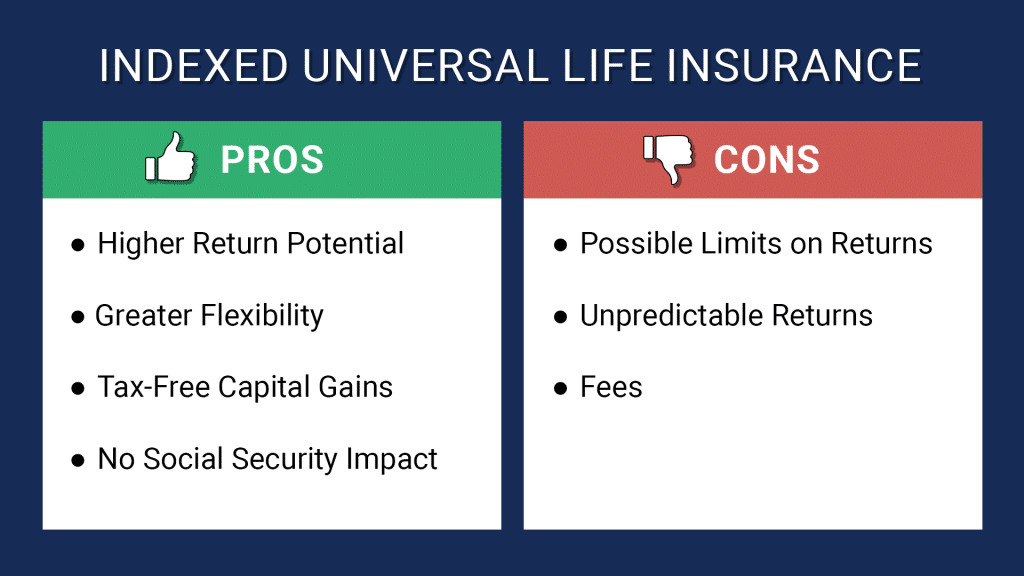

Pros:

- Tax-Deferred Growth: The cash value of an IUL policy grows tax-deferred, meaning you won’t have to pay taxes on the gains until you withdraw them.

- Potential for Higher Returns: IUL policies are linked to the performance of a specific stock market index, which means you may earn higher returns than traditional fixed annuities or whole life insurance.

- Flexibility: IUL policies offer flexible premium payments, allowing you to adjust your payments based on your financial situation.

- Tax-Free Withdrawals: You can withdraw cash from your policy tax-free, as long as you’re using the funds for qualified expenses, such as paying premiums or paying for healthcare expenses.

- Death Benefit: IUL policies provide a death benefit to your beneficiaries, which can help them pay for final expenses, taxes, and other financial obligations.

Cons:

- Risk of Negative Returns: If the index linked to your policy performs poorly, you may experience negative returns or even a loss of principal.

- Fees and Charges: IUL policies often come with fees and charges, such as administrative fees, surrender charges, and commissions, which can eat into your returns.

- Complexity: IUL policies can be complex and difficult to understand, making it challenging to navigate the various features and options.

- Risk of Policy Lapse: If you don’t pay your premiums or if the policy lapses, you may lose the death benefit and any accumulated cash value.

- Limited Liquidity: IUL policies are designed to provide a long-term savings component, which means you may not be able to access your funds quickly or easily if you need them.

- Cap on Gains: IUL policies often come with a cap on the gains you can earn, which means you may not earn as much as you would with a traditional investment.

- Riders and Add-Ons: IUL policies often offer riders and add-ons, such as guaranteed minimum interest rates or guaranteed death benefits, which can increase the cost of the policy and reduce the potential for returns.

Who is Indexed Universal Life Insurance Suitable For?

IUL insurance may be suitable for individuals who:

- Are looking for a long-term savings component

- Want to potentially earn higher returns than traditional fixed annuities or whole life insurance

- Need a tax-deferred savings vehicle

- Are willing to take on some level of risk

- Have a solid understanding of the policy’s features and options

Conclusion

Indexed Universal Life Insurance is a complex product that can offer both benefits and drawbacks. While it can provide tax-deferred growth and potential for higher returns, it also comes with risks and fees. It’s essential to carefully evaluate the pros and cons of IUL insurance and consider your individual financial situation and goals before making a decision. If you’re considering an IUL policy, be sure to work with a licensed insurance professional who can help you understand the policy’s features and options.

[ad_2]