Alternative Lending: Is the Era of Traditional Banks Coming to an End?

Title: Alternative Lending: Is the Era of Traditional Banks Coming to an End?

In recent years, the financial landscape has undergone a significant transformation, with the rise of alternative lending platforms challenging the dominance of traditional banks. Alternative lending, also known as fintech lending, has emerged as a game-changer in the financial industry, offering faster, more flexible, and more accessible credit options to individuals and businesses.

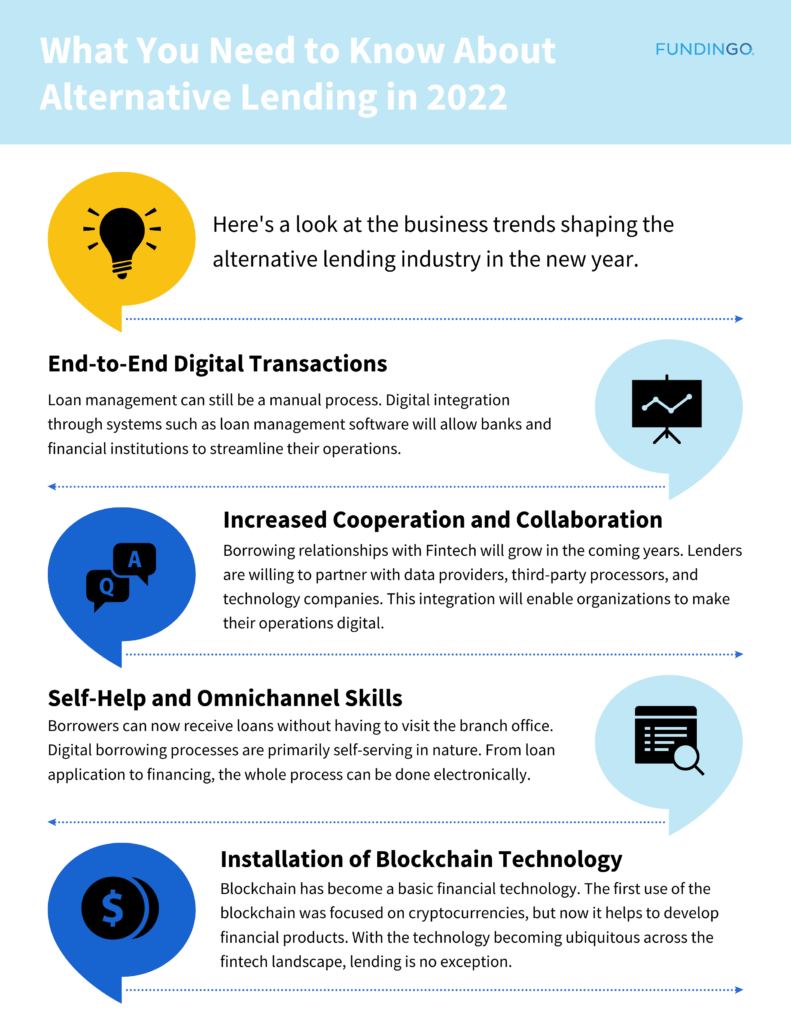

Traditional banks, which have long been the primary providers of credit, are facing increased competition from alternative lenders. These new entrants are leveraging technology and innovative business models to offer more competitive interest rates, faster loan processing times, and a more personalized customer experience. As a result, traditional banks are being forced to adapt and evolve to remain relevant in an increasingly digital and competitive marketplace.

So, is the era of traditional banks coming to an end? While traditional banks will likely continue to play a role in the financial system, the rise of alternative lending is undoubtedly changing the way credit is accessed and managed.

The Benefits of Alternative Lending

Alternative lenders have introduced several innovations that have disrupted the traditional banking model. Some of the key benefits of alternative lending include:

- Faster Loan Processing: Alternative lenders use algorithms and machine learning to quickly assess creditworthiness, reducing the time it takes to process loan applications. This means that borrowers can access funds faster, often within hours or days, rather than weeks or months.

- More Flexible Credit Options: Alternative lenders offer a range of credit products that cater to specific needs, such as short-term loans, invoice financing, and peer-to-peer lending. This diversity of options allows borrowers to choose the product that best suits their needs.

- Competitive Interest Rates: Alternative lenders can offer more competitive interest rates than traditional banks, as they have lower operational costs and can pass the savings on to borrowers.

- Personalized Customer Experience: Alternative lenders use data and analytics to provide a more personalized experience, understanding the needs and preferences of individual borrowers.

The Rise of Alternative Lenders

The alternative lending market has grown rapidly in recent years, with a wide range of lenders emerging to cater to different segments of the market. Some of the most popular alternative lending platforms include:

- Peer-to-Peer Lending: Platforms like Lending Club and Prosper allow individuals to lend to other individuals, bypassing traditional banks.

- Online Lenders: Online lenders like SoFi and Funding Circle offer a range of credit products, including personal loans, business loans, and mortgages.

- Fintech Lenders: Fintech lenders like Revolut and N26 offer a range of financial services, including lending, currency exchange, and payment processing.

- Specialized Lenders: Specialized lenders like Funding Circle (small business loans) and Zopa (personal loans) focus on specific segments of the market.

The Future of Traditional Banks

While alternative lending is certainly changing the financial landscape, traditional banks are not going extinct. Instead, they are adapting to the new reality by investing in digital transformation, partnering with fintech companies, and offering their own online lending platforms.

In fact, many traditional banks are recognizing the benefits of alternative lending and are incorporating fintech solutions into their operations. For example, some banks are using alternative lending platforms to offer small business loans, while others are partnering with fintech companies to offer digital payment solutions.

Conclusion

The rise of alternative lending is undoubtedly a game-changer in the financial industry, offering faster, more flexible, and more accessible credit options to individuals and businesses. While traditional banks will likely continue to play a role in the financial system, they must adapt and evolve to remain relevant in an increasingly digital and competitive marketplace.

As the alternative lending market continues to grow and evolve, it is likely that traditional banks will need to rethink their business models and invest in digital transformation to remain competitive. Ultimately, the era of traditional banks may be coming to an end, but it is being replaced by a new era of fintech innovation and disruption.