Banking on Technology: How AI, Machine Learning, and Automation are Transforming the Industry

Banking on Technology: How AI, Machine Learning, and Automation are Transforming the Industry

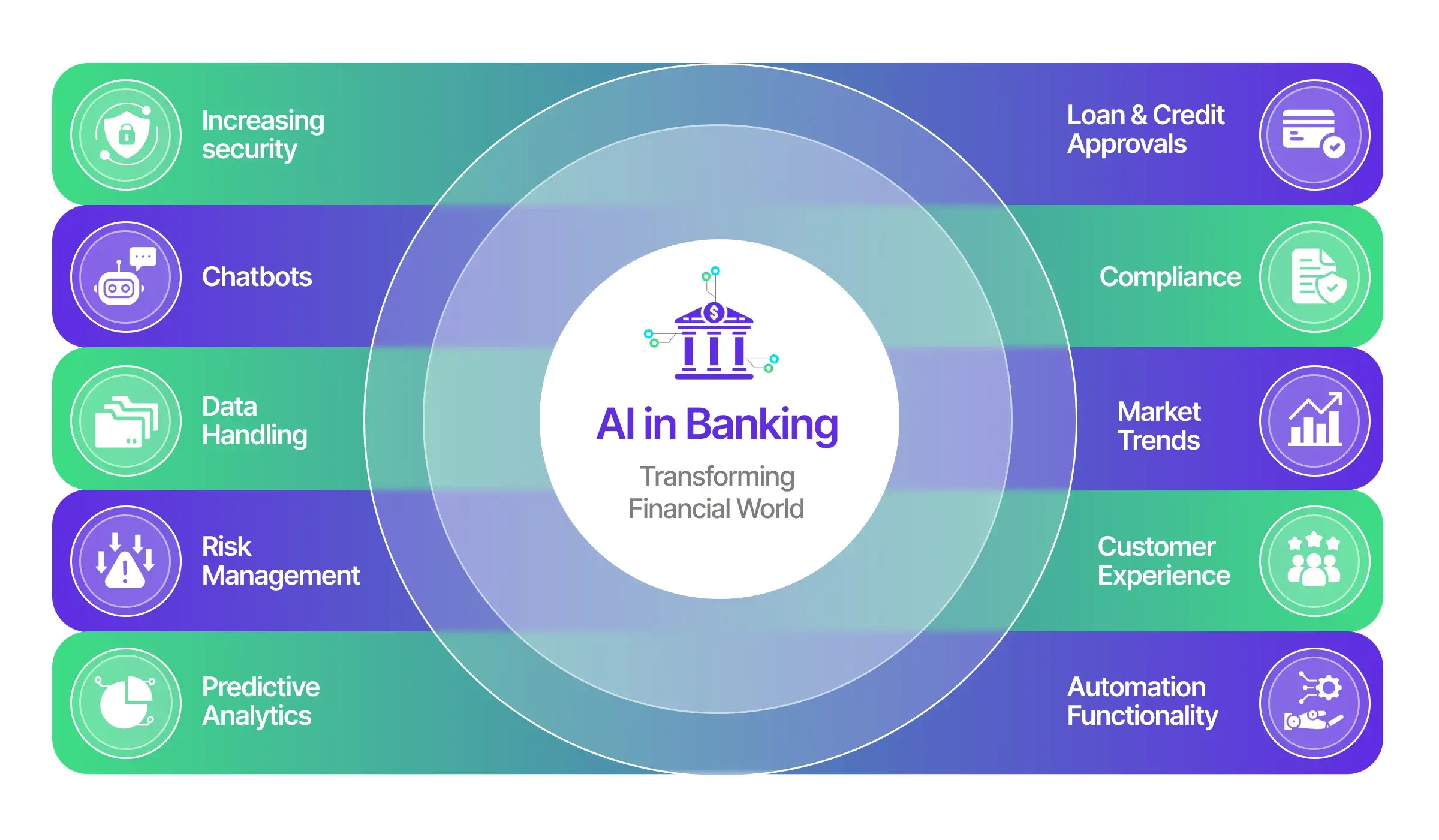

The banking industry has undergone significant transformations in recent years, driven by the rapid advancements in technology. Artificial intelligence (AI), machine learning (ML), and automation are revolutionizing the way banks operate, making them more efficient, customer-centric, and resilient to regulatory changes. In this article, we will explore how these technologies are transforming the banking industry and what benefits they bring to customers and institutions alike.

Automation: Streamlining Processes

Automation is one of the most significant areas of investment for banks in recent years. By automating repetitive and mundane tasks, banks can free up staff to focus on more complex and value-added activities. For example, robotic process automation (RPA) is being used to automate tasks such as account opening, customer onboarding, and claims processing. This not only reduces errors but also enables banks to process transactions faster and more accurately.

Machine Learning: Enhancing Risk Management

Machine learning algorithms are being used to analyze large datasets and identify patterns that can help banks better manage risk. For instance, ML can be used to identify potential fraud patterns in transactions, enabling banks to take proactive measures to prevent financial losses. Additionally, ML can be used to analyze customer behavior and identify potential defaults, allowing banks to offer targeted credit products and reduce credit risk.

Artificial Intelligence: Improving Customer Experience

Artificial intelligence is being used to improve customer experience in various ways. For example, chatbots are being used to provide 24/7 customer support, enabling customers to quickly resolve issues without having to speak to a human representative. AI-powered virtual assistants can also be used to help customers manage their accounts, track their spending, and receive personalized financial advice.

Benefits of Banking on Technology

The adoption of AI, ML, and automation in banking is bringing numerous benefits to both customers and institutions. Some of the key benefits include:

- Increased Efficiency: Automation and AI-powered processes are reducing the time and resources required to complete tasks, enabling banks to process transactions faster and more accurately.

- Improved Customer Experience: AI-powered chatbots and virtual assistants are providing customers with 24/7 support, helping them to quickly resolve issues and manage their accounts.

- Enhanced Risk Management: ML algorithms are enabling banks to better identify and manage risk, reducing the likelihood of financial losses and improving overall resilience.

- Cost Savings: Automation and AI-powered processes are reducing the need for manual labor, enabling banks to save costs and improve their bottom line.

Challenges and Opportunities

While the adoption of AI, ML, and automation in banking is bringing numerous benefits, there are also challenges and opportunities to consider. Some of the key challenges include:

- Data Quality: The quality of data used to train AI and ML algorithms is critical to their effectiveness. Poor data quality can lead to inaccurate results and reduced performance.

- Cybersecurity: As banks rely more heavily on technology, the risk of cyber attacks and data breaches increases. Banks must ensure that their systems and data are secure and protected from unauthorized access.

- Job Displacement: The automation of tasks and processes may displace some jobs, particularly those that are repetitive or can be easily automated. Banks must consider the impact of automation on their workforce and develop strategies to support employees who may be displaced.

Conclusion

The banking industry is undergoing a significant transformation driven by the adoption of AI, ML, and automation. These technologies are enabling banks to streamline processes, improve customer experience, and enhance risk management. While there are challenges and opportunities to consider, the benefits of banking on technology are clear. As the industry continues to evolve, it is essential for banks to stay at the forefront of technological innovation, ensuring that they remain competitive and resilient in an ever-changing landscape.