Coverage and Policies

[ad_1]

Understanding Coverage and Policies: The Key to a Smooth Experience

In today’s complex and often chaotic world, it’s essential to have the right coverage and policies in place to protect ourselves, our loved ones, and our possessions. Whether it’s health insurance, home insurance, car insurance, or any other type of coverage, having a clear understanding of what is and isn’t covered can be the difference between a minor setback and a major financial burden.

In this article, we’ll delve into the importance of coverage and policies, exploring what they are, why they’re essential, and how to navigate the complexities of choosing the right coverage for your unique needs.

What are Coverage and Policies?

Coverage and policies refer to the terms and conditions that outline the specifics of what is covered, how much it will cost, and what is expected of you as the policyholder. Policies are typically written in technical language and can be overwhelming, which is why it’s crucial to take the time to thoroughly understand what you’re buying before committing to a policy.

Why Are Coverage and Policies Important?

Having the right coverage and policies in place is crucial for several reasons:

- Protection: Coverage and policies provide protection against unexpected events, such as accidents, illnesses, or natural disasters, which can result in financial loss or damage to property.

- Financial Security: Having coverage and policies can provide peace of mind, knowing that you’re financially protected in the event of an unexpected event.

- Compliance: Many types of coverage and policies are mandatory, such as health insurance, auto insurance, or homeowners insurance, and failure to comply can result in penalties or legal consequences.

- Recovery: In the event of a loss or damage, coverage and policies can provide the necessary funds to recover and get back on track.

Types of Coverage and Policies

There are numerous types of coverage and policies, including:

- Health Insurance: Covers medical expenses, doctor visits, hospital stays, and prescriptions.

- Auto Insurance: Covers damage to vehicles, injuries to drivers and passengers, and third-party liability.

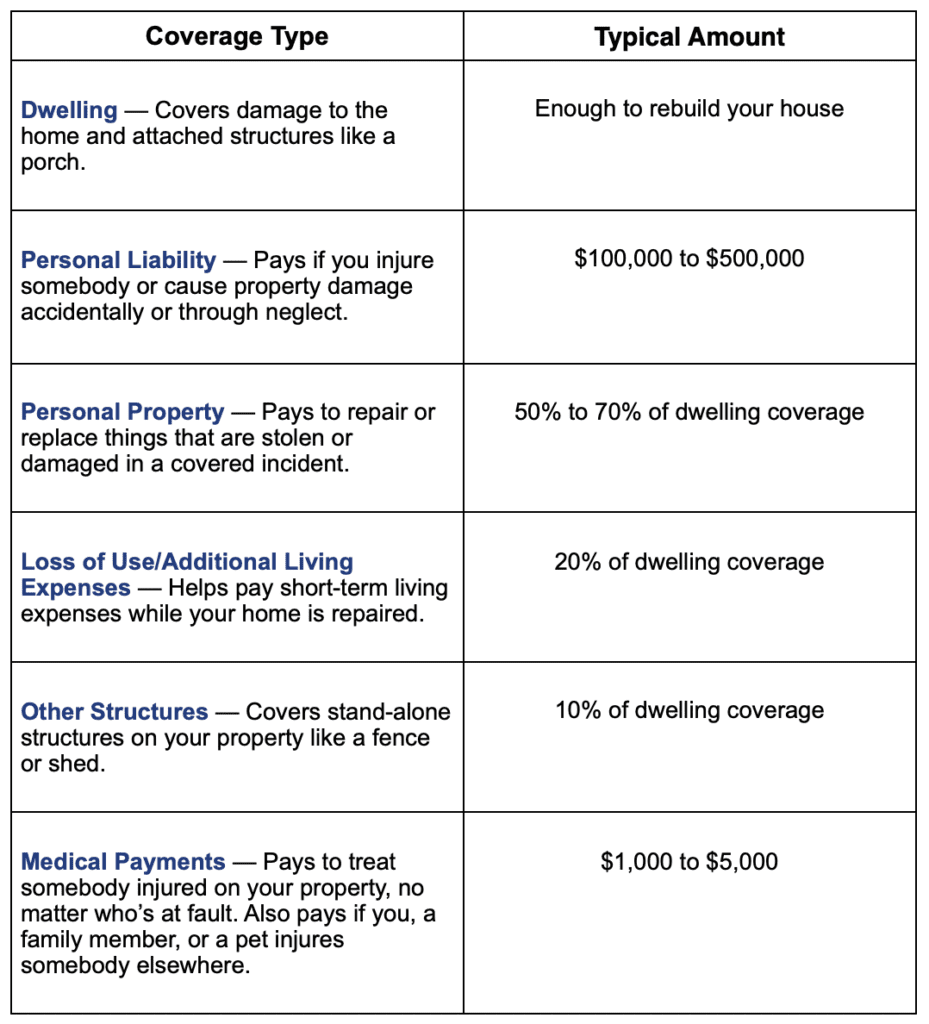

- Homeowners Insurance: Covers damage to property, liability, and personal belongings.

- Life Insurance: Provides financial protection for dependents in the event of death.

- Disability Insurance: Covers income replacement in the event of injury or illness.

How to Choose the Right Coverage and Policies

Choosing the right coverage and policies can be a daunting task, but here are some tips to help you make an informed decision:

- Assess Your Needs: Determine what you need to be covered for, such as property, health, or liability.

- Research: Research different policies and providers to compare coverage, costs, and reputation.

- Read the Fine Print: Carefully review the policy terms and conditions, paying attention to exclusions, limitations, and conditions.

- Ask Questions: Don’t hesitate to ask questions if you’re unsure about something.

- Seek Professional Advice: Consider consulting with a financial advisor or insurance professional to help you navigate the process.

Conclusion

Coverage and policies are essential tools for protecting ourselves, our loved ones, and our possessions. By understanding what coverage and policies are, why they’re important, and how to choose the right ones, you can rest assured that you’re well-prepared for whatever life may throw your way. Remember to always research, read the fine print, and ask questions to ensure that you have the right coverage and policies in place to keep you safe and secure.

[ad_2]