Coverage Capped: How to Optimize Your Policy Limits

[ad_1]

Coverage Capped: How to Optimize Your Policy Limits

As a responsible property owner, you know the importance of having adequate insurance coverage to protect your assets from unexpected losses. However, with the ever-rising costs of living and doing business, it’s becoming increasingly crucial to optimize your policy limits to ensure you’re not leaving yourself vulnerable to financial disaster. In this article, we’ll delve into the concept of coverage capped and provide expert advice on how to optimize your policy limits to safeguard your future.

What is Coverage Capped?

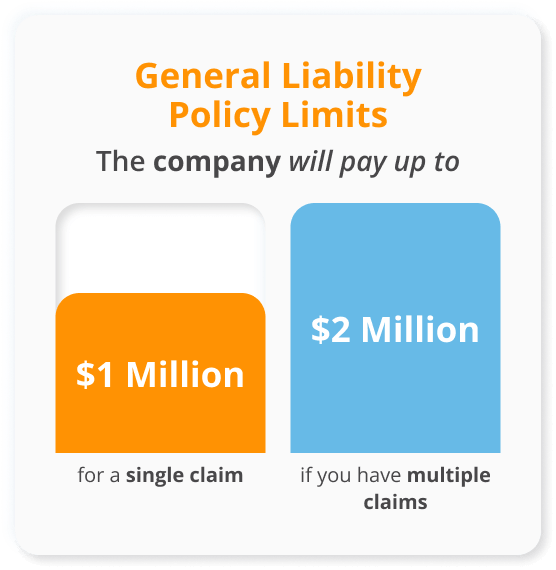

Coverage capped refers to the maximum amount of insurance coverage provided by your policy, which is typically limited by the policy’s aggregate limits. For instance, if your business insurance policy has a coverage capped at $1 million, this means that the insurer will only pay out up to $1 million in the event of a claim, regardless of the actual damages incurred.

Why Optimize Your Policy Limits?

Optimizing your policy limits is crucial to avoid financial losses in the event of a catastrophic event. Here are some compelling reasons to review and adjust your policy limits:

- Unforeseen Risks: Unforeseen risks and uncertainties can arise at any moment, such as natural disasters, cyber attacks, or unexpected changes in market conditions. Having adequate coverage can help mitigate the financial impact of these unforeseen events.

- Business Interruption: Business interruption coverage can help you recover from losses caused by unforeseen events, such as supply chain disruptions, equipment failures, or natural disasters. Optimal policy limits ensure you have sufficient funds to maintain business operations and recover from unexpected setbacks.

- Inflation and Rising Costs: Inflation and rising costs can quickly erode the purchasing power of your insurance coverage. By optimizing your policy limits, you can ensure that your coverage keeps pace with inflation and rising costs.

- Legal and Regulatory Requirements: Some industries or jurisdictions may require specific minimum coverage limits to comply with regulations. Optimizing your policy limits ensures you meet these requirements and avoid costly fines or penalties.

How to Optimize Your Policy Limits

To optimize your policy limits, follow these expert tips:

- Conduct a Risk Assessment: Conduct a thorough risk assessment to identify potential risks and exposures that could impact your business.

- Determine Your Coverage Needs: Based on your risk assessment, determine the coverage limits you need to ensure your business is adequately protected.

- Review Your Policy: Review your policy to identify areas where coverage limits may be insufficient or outdated.

- Consult with an Insurance Professional: Consult with an experienced insurance professional to determine the optimal coverage limits for your business.

- Consider Excess Insurance: Consider purchasing excess insurance to supplement your primary coverage and provide additional protection against unforeseen losses.

- Monitor and Adjust: Regularly monitor your policy limits and adjust as needed to ensure they remain adequate and aligned with your business’s evolving needs.

Conclusion

In conclusion, optimizing your policy limits is a critical step in protecting your business from unexpected losses and ensuring you’re adequately prepared for the future. By understanding coverage capped and following the expert tips outlined in this article, you can rest assured that your policy limits are aligned with your business’s evolving needs and risks. Remember, it’s always better to err on the side of caution and invest in adequate coverage to safeguard your future.

[ad_2]