How to Manage Your Finances Like a Pro: Tips from a Banking Expert

[ad_1]

How to Manage Your Finances Like a Pro: Tips from a Banking Expert

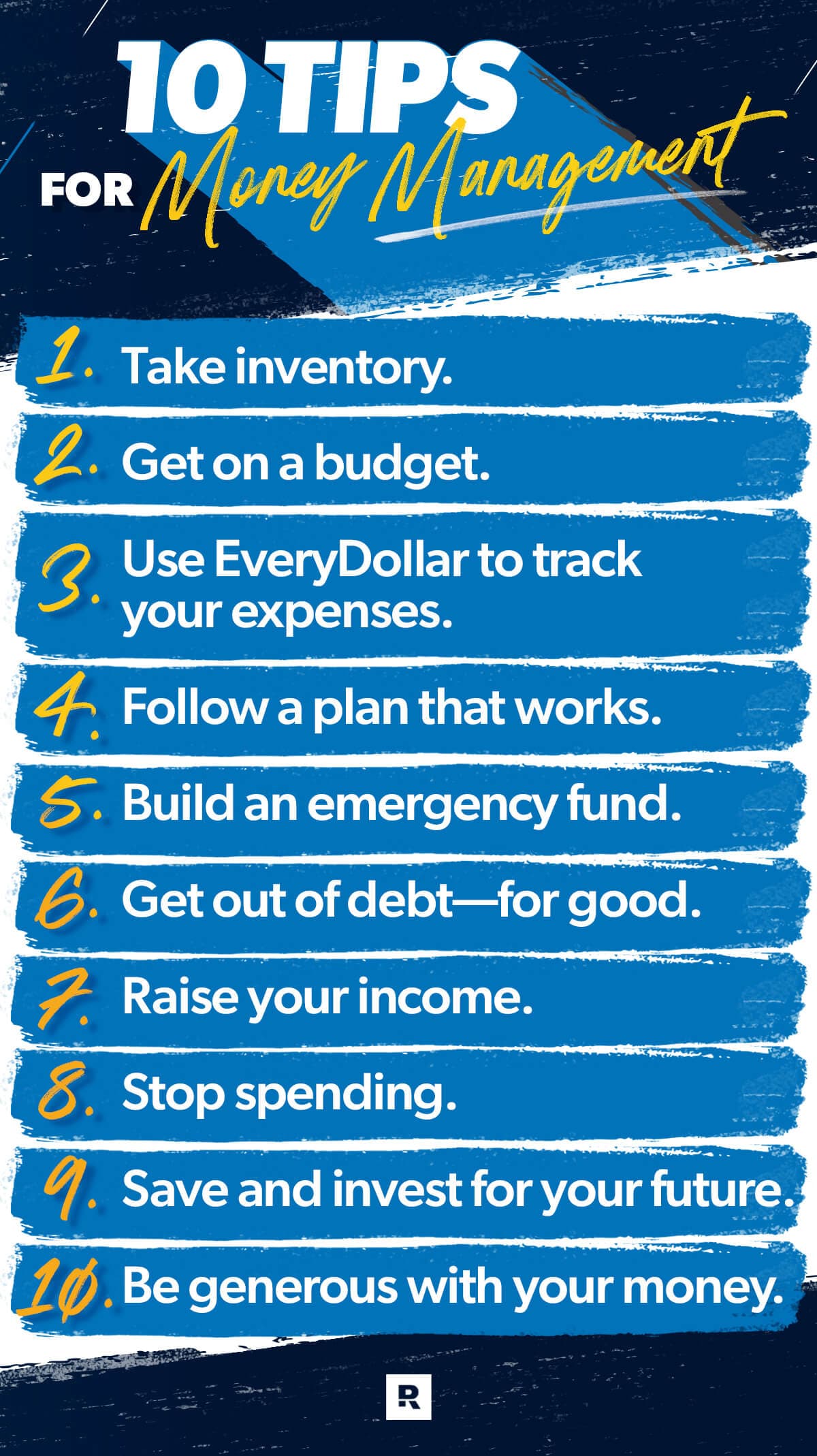

Managing your finances effectively is crucial for achieving financial stability, security, and success. However, it can be overwhelming, especially for those who are new to personal finance or struggling to make ends meet. As a banking expert, I’ve seen many individuals struggle with financial management, but with the right strategies and mindset, anyone can become a pro at managing their finances.

In this article, I’ll share my top tips on how to manage your finances like a pro, based on my years of experience in the banking industry. From budgeting and saving to investing and debt management, I’ll cover it all.

Tip 1: Track Your Expenses

The first step to managing your finances like a pro is to track your expenses. This may seem simple, but it’s often the most overlooked step. Write down every single transaction, no matter how small, in a notebook or use an app like Mint or Personal Capital to track your spending. This will help you identify areas where you can cut back and make adjustments to your budget.

Tip 2: Create a Budget

Once you’ve tracked your expenses, it’s time to create a budget. A budget is a plan for how you’ll allocate your income towards different expenses. It should include categories for essential expenses like rent/mortgage, utilities, and groceries, as well as discretionary expenses like entertainment and travel. Be sure to prioritize your needs over your wants, and make adjustments as needed.

Tip 3: Prioritize Saving

Saving is essential for achieving financial stability and security. Aim to save at least 10% to 20% of your income each month. You can set up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

Tip 4: Pay Off High-Interest Debt

High-interest debt, such as credit card debt, can be a major financial burden. Prioritize paying off these debts as quickly as possible by paying more than the minimum payment each month. Consider consolidating debt into a lower-interest loan or balance transfer credit card.

Tip 5: Build an Emergency Fund

An emergency fund is a crucial component of financial stability. Aim to save 3-6 months’ worth of living expenses in an easily accessible savings account. This fund will help you avoid going into debt when unexpected expenses arise.

Tip 6: Invest Wisely

Investing can seem intimidating, but it’s a crucial step in building long-term wealth. Start by setting clear financial goals, such as saving for retirement or a down payment on a house. Then, consider working with a financial advisor or using a robo-advisor to create a diversified investment portfolio.

Tip 7: Monitor and Adjust

Finally, it’s essential to regularly monitor your finances and make adjustments as needed. Review your budget and spending habits regularly to identify areas for improvement. Make adjustments to your budget and investment portfolio as your financial goals and circumstances change.

Conclusion

Managing your finances like a pro requires discipline, patience, and a willingness to learn. By following these tips, you’ll be well on your way to achieving financial stability, security, and success. Remember to track your expenses, create a budget, prioritize saving, pay off high-interest debt, build an emergency fund, invest wisely, and monitor and adjust your finances regularly. With these strategies and a little practice, you’ll be a pro at managing your finances in no time.

[ad_2]