Personal Finance

Mastering Personal Finance: A Guide to Achieving Financial Freedom

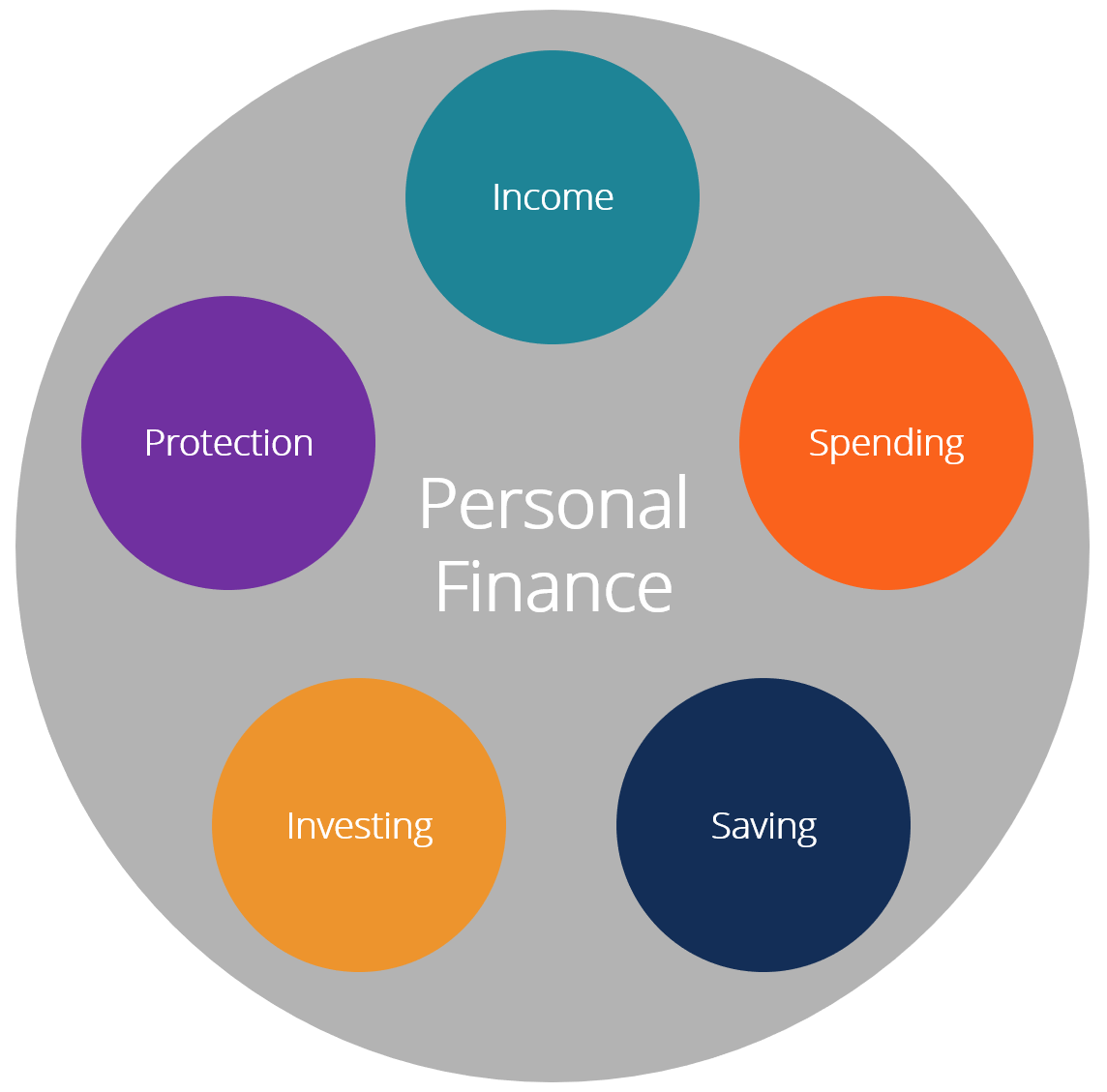

Personal finance is a crucial aspect of our lives that plays a significant role in shaping our financial futures. It involves managing our income, expenses, savings, and investments to achieve our long-term financial goals. In today’s uncertain economic climate, it’s essential to be proactive and take control of your personal finances to ensure a secure and prosperous financial future.

Understanding Your Finances

The first step to mastering personal finance is to understand your financial situation. Start by tracking your income and expenses to identify areas where you can cut back and allocate your resources more effectively. Create a budget that outlines your income, fixed expenses, and discretionary spending. This will help you prioritize your financial needs and make informed decisions about how to allocate your money.

Saving and Investing

Saving and investing are crucial components of personal finance. Aim to save at least 10% to 20% of your income for short-term goals, such as emergency funds, retirement, and major purchases. Invest your savings in a diversified portfolio that includes low-risk investments, such as bonds and CDs, and higher-risk investments, such as stocks and real estate.

Debt Management

High-interest debt, such as credit card balances, can be a significant obstacle to achieving financial freedom. Prioritize paying off high-interest debt first, while making minimum payments on other debts. Consider consolidating debt into a single, lower-interest loan or credit card.

Credit and Insurance

Maintaining a good credit score is essential for securing loans and credit at competitive interest rates. Monitor your credit report and dispute any errors or inaccuracies. Consider purchasing insurance to protect yourself against unexpected events, such as accidents, illnesses, and natural disasters.

Retirement Planning

Retirement planning is an essential aspect of personal finance. Start saving for retirement as early as possible, and take advantage of employer-matched retirement accounts, such as 401(k) or IRA. Consider consulting with a financial advisor to develop a personalized retirement plan.

Financial Goal Setting

Setting financial goals is essential for achieving financial freedom. Start by identifying your short-term and long-term financial objectives, such as paying off debt, buying a home, or retiring comfortably. Break down large goals into smaller, achievable milestones, and create a plan to achieve them.

Conclusion

Mastering personal finance requires discipline, patience, and a long-term perspective. By understanding your financial situation, saving and investing, managing debt, maintaining good credit, planning for retirement, and setting financial goals, you can achieve financial freedom and secure a prosperous financial future. Remember, personal finance is a journey that requires ongoing effort and attention, but the rewards are well worth the effort.

Tips and Resources

- Create a budget and track your expenses using apps like Mint or Personal Capital.

- Take advantage of employer-matched retirement accounts, such as 401(k) or IRA.

- Consider consulting with a financial advisor or using online resources, such as the Financial Industry Regulatory Authority (FINRA) or the Securities and Exchange Commission (SEC).

- Read books and articles on personal finance, such as "A Random Walk Down Wall Street" or "The Total Money Makeover."

- Join online communities or forums, such as Reddit’s r/personalfinance, to connect with others who share your financial goals and challenges.