The Benefits of a Joint Bank Account: When to Consider Sharing Your Finances

[ad_1]

Title: The Benefits of a Joint Bank Account: When to Consider Sharing Your Finances

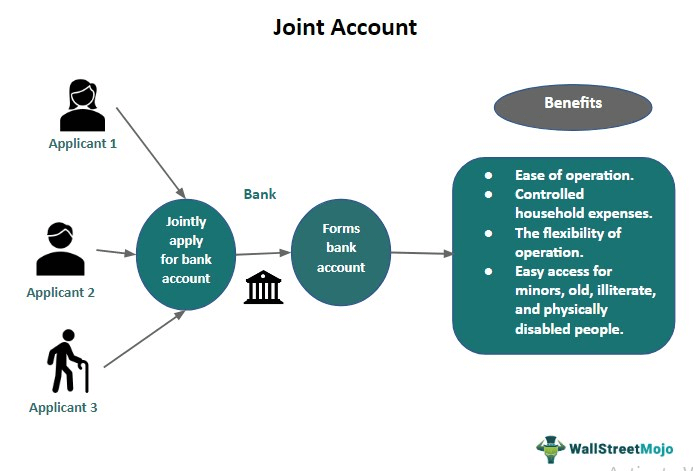

Are you considering sharing your finances with your partner, family member, or business partner? A joint bank account can be a great way to manage your money together, but it’s essential to understand the benefits and potential drawbacks before making a decision.

Benefits of a Joint Bank Account:

- Easy Money Management: A joint bank account allows you to combine your finances, making it easier to track expenses, budget, and plan for the future.

- Increased Transparency: With a joint account, you and your partner or business partner can see each other’s transactions, helping to eliminate financial surprises and build trust.

- Improved Financial Discipline: Sharing a joint account can encourage you and your partner to make more responsible financial decisions, as you’ll be held accountable for each other’s spending habits.

- Simplified Bill Pay: Joint accounts make it easy to pay bills and manage expenses, reducing the likelihood of missed payments or late fees.

- Tax Benefits: Depending on your tax situation, a joint account can provide tax benefits, such as a lower tax bracket or increased deductions.

- Enhanced Communication: Sharing a joint account can foster open and honest communication about your financial goals, values, and priorities.

When to Consider a Joint Bank Account:

- Long-Term Relationship: If you’re in a long-term committed relationship, a joint account can be a great way to build a stronger financial foundation and demonstrate your commitment to each other.

- Business Partnerships: If you’re in a business partnership, a joint account can help streamline financial operations, reduce paperwork, and increase transparency.

- Financial Goals: If you and your partner or business partner have shared financial goals, such as buying a home, planning for retirement, or funding a business venture, a joint account can help you work together to achieve those goals.

- Emergency Funds: A joint account can provide an emergency fund, ensuring that you and your partner or business partner have access to funds in case of unexpected expenses or financial setbacks.

Potential Drawbacks:

- Loss of Control: When you share a joint account, you may feel like you’re losing control over your own finances, which can be a significant concern for some individuals.

- Financial Conflicts: Sharing a joint account can lead to financial conflicts, especially if you and your partner or business partner have different spending habits or financial priorities.

- Liability: In the event of a dispute or financial crisis, a joint account can make one partner or business partner liable for the other’s financial decisions.

To Minimize Risks:

- Set Clear Boundaries: Establish clear boundaries and expectations for your joint account, including spending limits and financial goals.

- Monitor Transactions: Regularly review transactions to ensure that you’re both on the same page and making responsible financial decisions.

- Consider a Separate Account: Consider opening a separate account for individual expenses, allowing you to maintain some financial independence while still sharing a joint account for shared expenses.

In conclusion, a joint bank account can be a valuable tool for managing your finances with a partner, family member, or business partner. While there are potential drawbacks to consider, the benefits of increased transparency, improved financial discipline, and simplified bill pay can be significant. By setting clear boundaries, monitoring transactions, and considering a separate account, you can minimize risks and make the most of your joint account.

[ad_2]