The Benefits of Whole Life Insurance vs. Term Life Insurance

[ad_1]

The Benefits of Whole Life Insurance vs. Term Life Insurance: Which is Right for You?

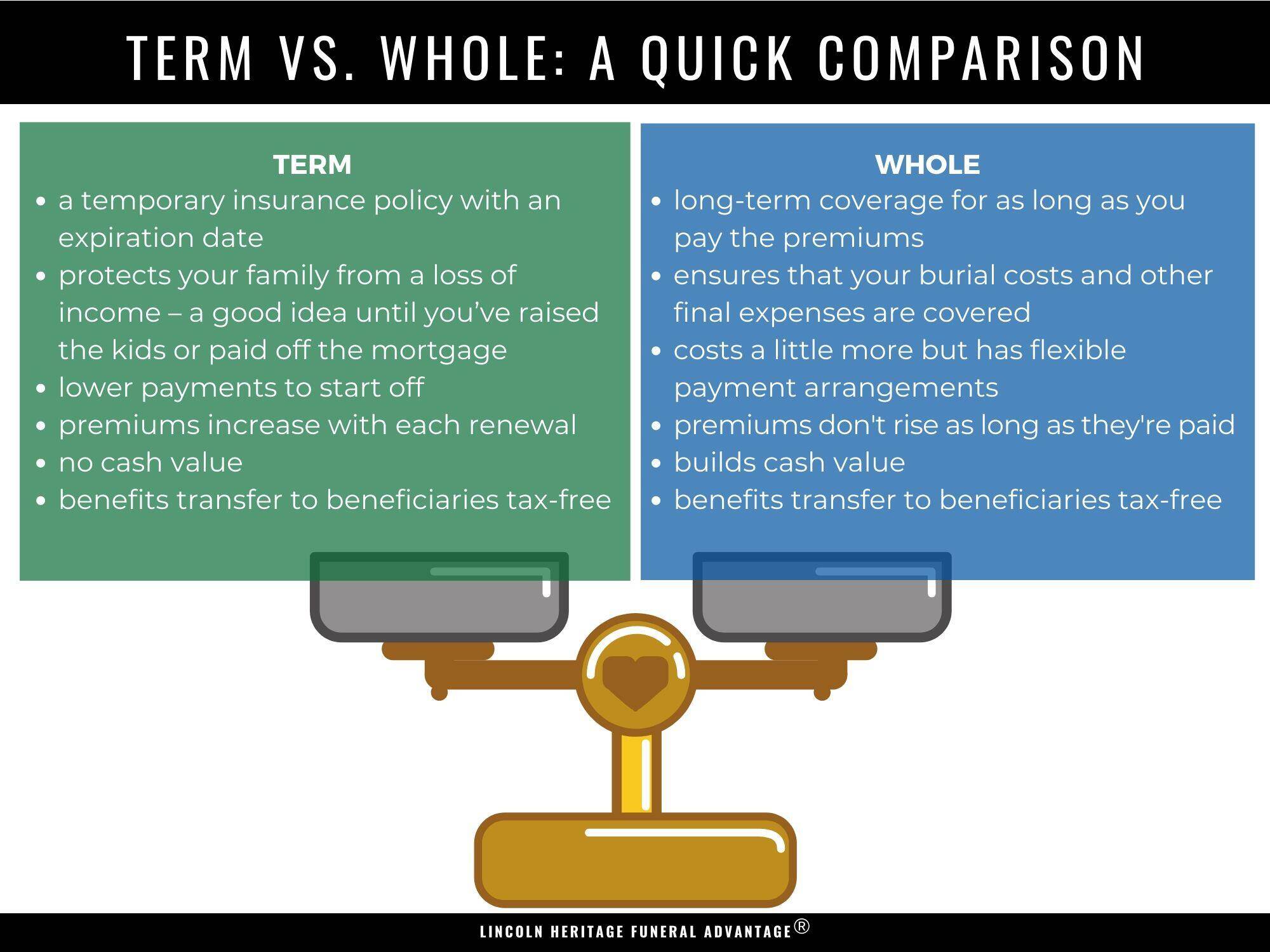

When it comes to life insurance, there are two primary types: term life insurance and whole life insurance. Both options provide financial protection for your loved ones in the event of your passing, but they differ significantly in terms of coverage duration, premiums, and benefits. In this article, we’ll explore the benefits of whole life insurance and how it compares to term life insurance.

Term Life Insurance: A Basic Protection

Term life insurance is a type of life insurance that provides coverage for a specified period, usually ranging from 10 to 30 years. During this time, the insurance company pays a death benefit to your beneficiaries if you pass away. The premiums are typically lower than those of whole life insurance, making it an attractive option for those on a budget.

However, term life insurance has some significant limitations. Once the coverage period expires, the policy terminates, and you may not be able to renew or convert it to a permanent policy. This means that if you outlive the coverage period, you’ll no longer have life insurance protection.

Whole Life Insurance: A Long-Term Investment

Whole life insurance, also known as permanent life insurance, provides coverage for your entire lifetime, as long as premiums are paid. This type of insurance combines a death benefit with a savings component, known as cash value, which grows over time. The cash value can be borrowed against or used to pay premiums.

The benefits of whole life insurance are numerous:

- Lifetime Coverage: Whole life insurance provides coverage for your entire lifetime, giving you peace of mind that your loved ones will be protected, no matter when you pass away.

- Cash Value: The cash value component of whole life insurance allows you to build a savings account that can be used to supplement your retirement income or cover unexpected expenses.

- Dividend Potential: Many whole life insurance policies pay dividends to policyholders, which can increase the policy’s cash value and death benefit.

- Tax Benefits: The cash value of a whole life insurance policy grows tax-deferred, meaning you won’t have to pay taxes on the gains until you withdraw them.

- Flexibility: Whole life insurance policies often offer flexible premium payments, allowing you to adjust your payments based on your financial situation.

Comparison: Whole Life Insurance vs. Term Life Insurance

| Whole Life Insurance | Term Life Insurance | |

|---|---|---|

| Coverage Duration | Lifetime | Specified period (10-30 years) |

| Premiums | Higher | Lower |

| Cash Value | Yes | No |

| Dividend Potential | Yes | No |

| Tax Benefits | Yes | No |

| Flexibility | Yes | Limited |

Conclusion

While term life insurance may be a more affordable option for those with limited budgets, whole life insurance offers a range of benefits that make it a more attractive choice for those seeking long-term protection and investment. The cash value component, dividend potential, and tax benefits of whole life insurance make it a valuable investment that can provide financial security for your loved ones.

Before making a decision, consider your financial situation, insurance needs, and long-term goals. It’s essential to weigh the pros and cons of each option and consult with a licensed insurance professional to determine which type of life insurance is right for you.

[ad_2]