The Evolution of Banking: How Technology is Changing the Industry

The Evolution of Banking: How Technology is Changing the Industry

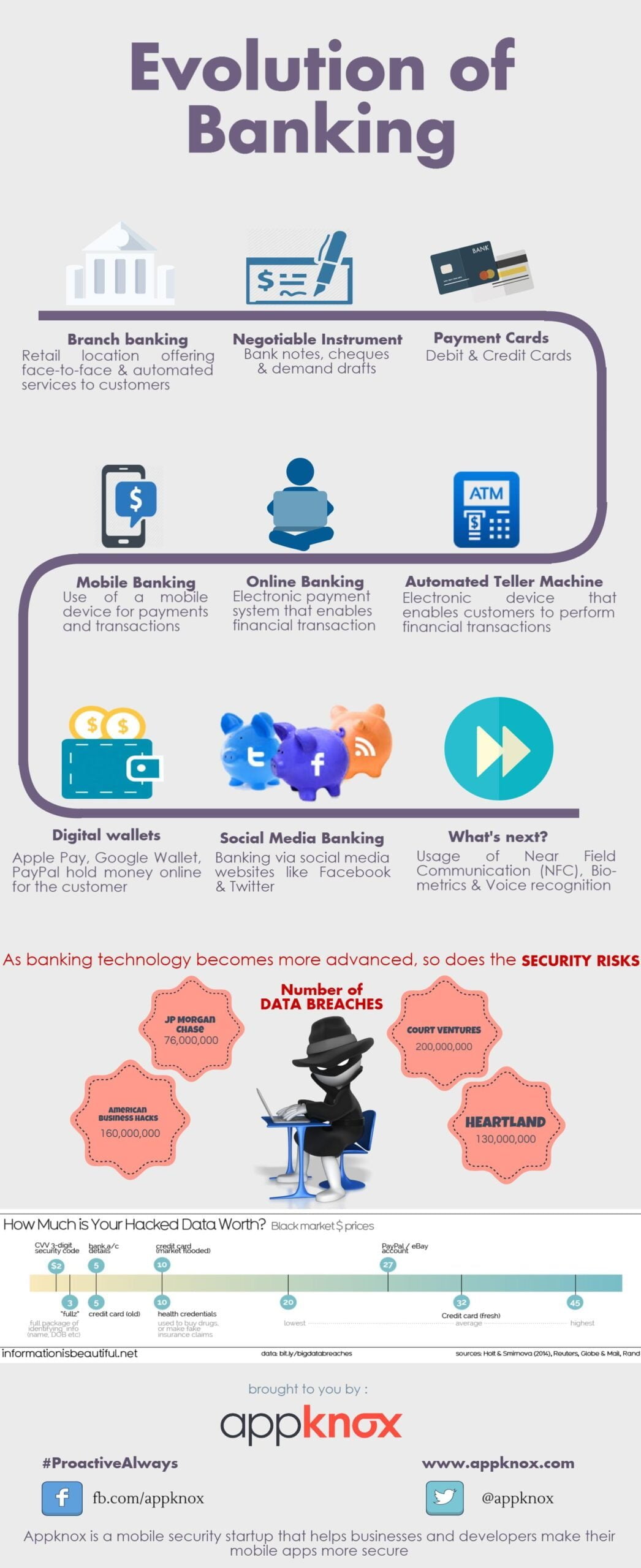

The banking industry has undergone significant transformations over the years, driven by advances in technology and changing consumer behaviors. From traditional brick-and-mortar banks to digital-only institutions, the way we interact with our money has changed dramatically. In this article, we’ll explore the evolution of banking and how technology is shaping the industry’s future.

Early Days of Banking

The first banks emerged in ancient civilizations, such as Greece and Rome, where gold and silver were used as currency. As trade and commerce grew, the need for a secure and efficient way to store and transfer wealth became apparent. The first modern banks were established in the 17th century, with the Bank of England (1694) and the Bank of France (1716) being among the earliest.

The Advent of Technology

The introduction of computers and the internet in the 1980s revolutionized the banking industry. Electronic Fund Transfers (EFTs) enabled customers to conduct transactions remotely, and online banking allowed for 24/7 access to accounts. This marked the beginning of a new era in banking, with technology becoming an essential component of the industry.

The Rise of Mobile Banking

The widespread adoption of smartphones in the 2000s led to the rise of mobile banking. Mobile apps enabled customers to manage their accounts, transfer funds, and pay bills on-the-go. This shift towards mobile banking has continued to accelerate, with many banks now offering mobile-only services.

Digital-Only Banks

The emergence of digital-only banks, such as Chime and Revolut, has disrupted the traditional banking model. These institutions operate solely online, with no physical branches, and offer innovative features such as real-time spending tracking and fee-free international transactions.

Blockchain and Cryptocurrencies

The rise of blockchain technology and cryptocurrencies like Bitcoin has also impacted the banking industry. Some banks are exploring the use of blockchain for secure transactions, while others are creating their own cryptocurrencies. This trend is expected to continue, with many experts predicting that blockchain will play a significant role in the future of banking.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are being increasingly used in banking to improve customer service, streamline operations, and reduce costs. AI-powered chatbots can assist with customer inquiries, while ML algorithms can analyze customer behavior to offer personalized financial advice.

The Future of Banking

As technology continues to evolve, the banking industry is likely to undergo further transformations. Some potential trends include:

- Increased use of biometrics: Biometric authentication, such as facial recognition and fingerprint scanning, may become more widespread, providing an additional layer of security for online transactions.

- Virtual banking assistants: AI-powered virtual assistants may become more common, allowing customers to interact with their banks in a more conversational and personalized way.

- Open banking: The open banking initiative, which allows customers to share their financial data with third-party providers, may lead to the development of new financial products and services.

- Cryptocurrencies and blockchain: The use of blockchain and cryptocurrencies is likely to continue, with many experts predicting that they will play a significant role in the future of banking.

Conclusion

The evolution of banking has been marked by significant technological advancements, from the introduction of computers and the internet to the rise of mobile banking and digital-only institutions. As technology continues to shape the industry, we can expect to see further innovations, such as the increased use of biometrics, virtual banking assistants, open banking, and cryptocurrencies. The future of banking is likely to be shaped by these trends, and it will be exciting to see how the industry continues to evolve in the years to come.