The Impact of Open Banking on Financial Institutions: Opportunities and Challenges

The Impact of Open Banking on Financial Institutions: Opportunities and Challenges

The financial industry is undergoing a significant transformation with the advent of open banking, a regulatory requirement that enables customers to share their financial data with third-party providers. This shift is poised to revolutionize the way financial institutions operate, presenting both opportunities and challenges for banks and other financial institutions.

Opportunities

Open banking offers several benefits to financial institutions, including:

- Increased customer engagement: By providing customers with easier access to their financial data, open banking can foster deeper relationships and encourage greater financial literacy.

- Innovation and competition: Open banking enables fintech companies and startups to develop innovative financial products and services, driving competition and innovation in the market.

- Improved customer experience: Financial institutions can leverage open banking to offer more personalized and tailored services, improving the overall customer experience.

- Reduced costs: Open banking can reduce costs associated with maintaining legacy systems and processes, allowing financial institutions to reallocate resources to more strategic areas.

- New revenue streams: Open banking presents opportunities for financial institutions to generate revenue through data analytics, APIs, and other value-added services.

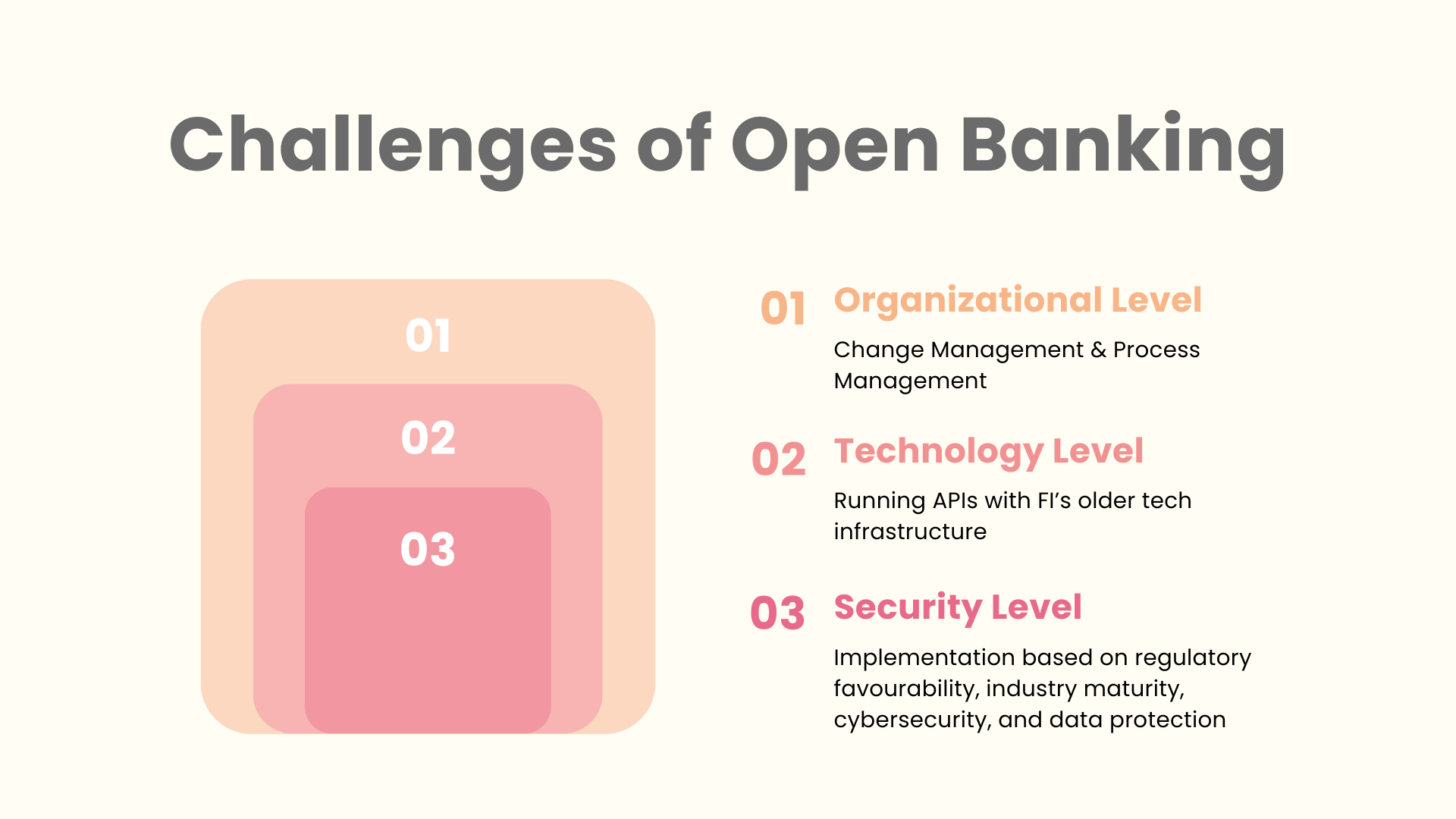

Challenges

However, open banking also poses several challenges for financial institutions, including:

- Data security and privacy concerns: The sharing of sensitive financial data raises concerns about data security and privacy, requiring financial institutions to implement robust security measures.

- Compliance and regulatory risks: Financial institutions must navigate complex regulatory requirements and ensure compliance with open banking standards.

- Integration and infrastructure challenges: Implementing open banking requires significant investments in technology and infrastructure, including APIs, data management systems, and security protocols.

- Competitive pressures: Open banking can lead to increased competition from fintech companies and other non-traditional players, potentially eroding market share and revenue.

- Risk of disintermediation: Open banking can create opportunities for disintermediation, where customers bypass traditional financial institutions to access financial services directly.

Strategies for Success

To capitalize on the opportunities and mitigate the challenges of open banking, financial institutions should consider the following strategies:

- Develop a clear open banking strategy: Define a clear vision and goals for open banking, and prioritize investments in technology and infrastructure.

- Build partnerships: Collaborate with fintech companies and other stakeholders to develop innovative products and services.

- Invest in data analytics and AI: Leverage data analytics and artificial intelligence to gain insights from customer data and improve customer experience.

- Enhance data security and privacy: Implement robust security measures to protect customer data and ensure compliance with regulatory requirements.

- Focus on customer engagement: Prioritize customer engagement and relationships to build trust and loyalty.

Conclusion

Open banking presents significant opportunities for financial institutions to innovate, improve customer experience, and generate new revenue streams. However, it also poses challenges related to data security, compliance, and competitive pressures. To succeed in this new landscape, financial institutions must develop a clear open banking strategy, build partnerships, invest in data analytics and AI, enhance data security and privacy, and focus on customer engagement. By doing so, they can capitalize on the opportunities and navigate the challenges of open banking.