The Importance of Budgeting: How to Create a Budget That Works for You

[ad_1]

The Importance of Budgeting: How to Create a Budget That Works for You

Budgeting is a crucial aspect of personal finance that is often overlooked or ignored. However, having a budget in place is essential for achieving financial stability, reducing debt, and building wealth. In this article, we will explore the importance of budgeting and provide a step-by-step guide on how to create a budget that works for you.

Why is Budgeting Important?

Budgeting is important for several reasons:

- Reduces Financial Stress: Without a budget, it’s easy to overspend and fall into debt, leading to financial stress and anxiety.

- Helps You Prioritize: A budget allows you to prioritize your spending, ensuring that you allocate your resources wisely and make conscious financial decisions.

- Increases Savings: A budget helps you save money by identifying areas where you can cut back and allocate funds towards savings and investments.

- Improves Financial Decision-Making: A budget helps you make informed financial decisions, avoiding impulse purchases and reckless spending.

- Enhances Financial Planning: A budget provides a roadmap for achieving your financial goals, whether it’s paying off debt, building an emergency fund, or planning for retirement.

How to Create a Budget That Works for You

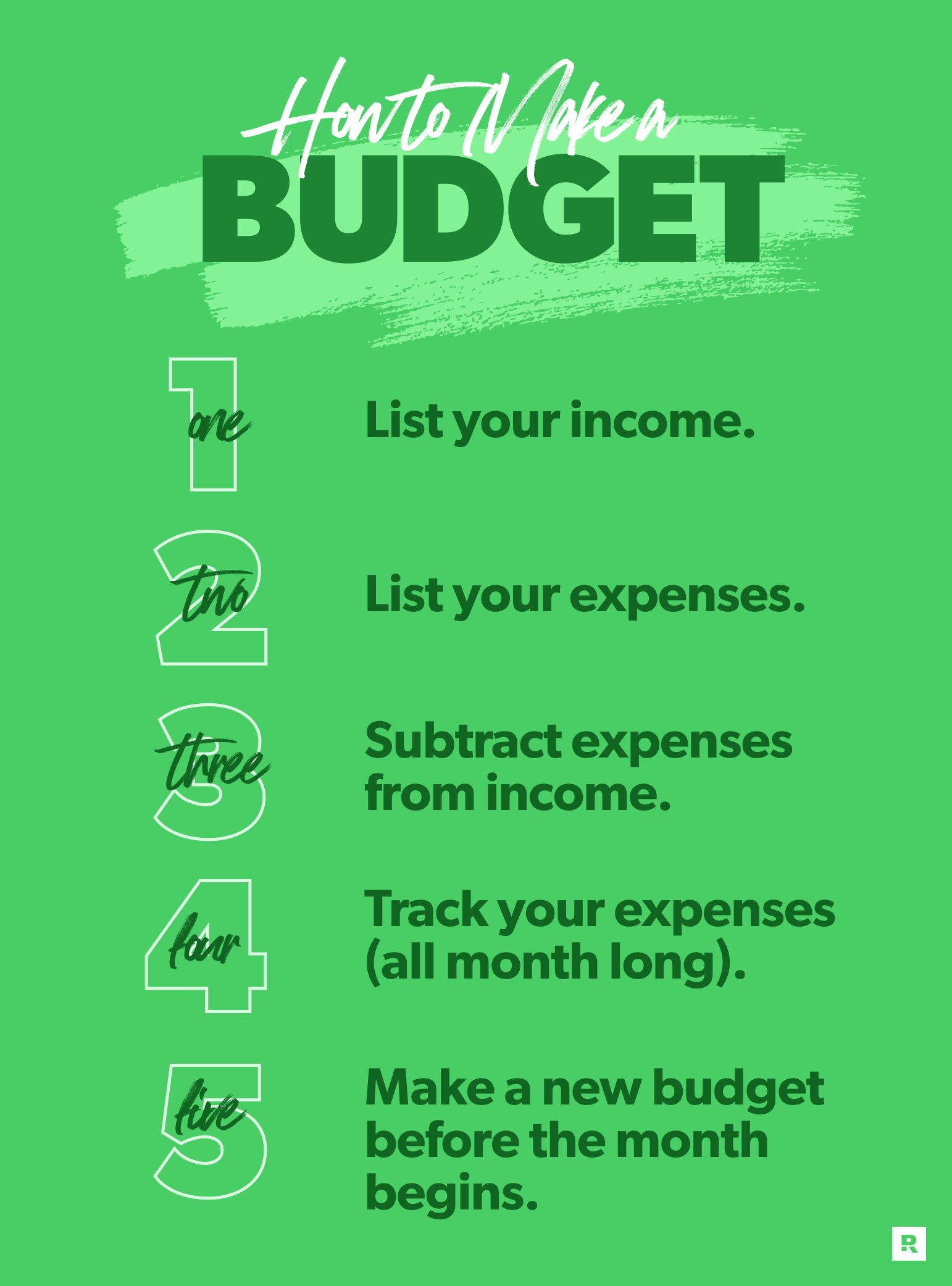

Creating a budget that works for you requires some effort, but it’s a worthwhile investment. Here’s a step-by-step guide to help you get started:

- Track Your Expenses: For one month, track every single transaction you make, including small purchases like coffee or snacks. This will give you a clear picture of where your money is going.

- Identify Your Goals: Determine what you want to achieve with your budget. Do you want to pay off debt, save for a down payment on a house, or build an emergency fund?

- Categorize Your Expenses: Divide your expenses into categories, such as:

- Housing (rent, utilities, maintenance)

- Transportation (car payment, insurance, gas)

- Food (groceries, dining out)

- Entertainment (movies, concerts, hobbies)

- Debt Repayment (credit cards, loans)

- Savings (emergency fund, retirement)

- Assign Percentage of Income: Allocate a percentage of your income to each category based on your priorities. For example, you may allocate 30% towards housing, 10% towards entertainment, and 20% towards debt repayment.

- Set Dollar Amounts: Convert the percentages into dollar amounts based on your income. For example, if you earn $4,000 per month, you may allocate $1,200 towards housing, $400 towards entertainment, and $800 towards debt repayment.

- Review and Adjust: Regularly review your budget to ensure you’re on track to meet your goals. Adjust your budget as needed to reflect changes in your income, expenses, or priorities.

- Automate: Set up automatic transfers from your checking account to your savings, investment, or debt repayment accounts to make saving and debt repayment easier and less prone to being neglected.

Tips for a Successful Budget

- Make It Realistic: Don’t set unrealistic goals or budget amounts that you’re unlikely to stick to.

- Prioritize Needs Over Wants: Distinguish between essential expenses (housing, food, utilities) and discretionary expenses (entertainment, hobbies).

- Avoid Impulse Purchases: Create a 30-day waiting period for non-essential purchases to help you avoid making impulse decisions.

- Use Cash: Consider using cash for discretionary expenses to help you stick to your budget and avoid overspending.

- Review and Adjust Regularly: Regularly review your budget to ensure you’re on track to meet your goals and make adjustments as needed.

In conclusion, budgeting is a crucial aspect of personal finance that helps you achieve financial stability, reduce debt, and build wealth. By following the steps outlined above, you can create a budget that works for you and helps you achieve your financial goals. Remember to make it realistic, prioritize needs over wants, and review and adjust regularly to ensure you’re on track to success.

[ad_2]