The Pros and Cons of Bank Account Interest Rates: How to Make the Most of Your Money

[ad_1]

The Pros and Cons of Bank Account Interest Rates: How to Make the Most of Your Money

In today’s economy, every penny counts, and making the most of your money is crucial. One of the simplest ways to do so is by maximizing your bank account interest rates. With so many options available, it can be overwhelming to decide which account is best for you. In this article, we’ll explore the pros and cons of bank account interest rates and provide tips on how to make the most of your money.

What are Bank Account Interest Rates?

Bank account interest rates refer to the percentage of your deposited funds that the bank pays you as interest. This interest can be earned on checking, savings, and money market accounts, as well as certificates of deposit (CDs) and other types of accounts. The interest rate is usually expressed as a decimal, such as 0.05% or 2.00%, and is calculated daily or monthly, depending on the account type.

Pros of Bank Account Interest Rates

- Passive Income: Earning interest on your deposited funds is a great way to generate passive income, which can help you build wealth over time.

- Compound Interest: When interest is compounded, the interest earned is reinvested, causing your account balance to grow faster.

- Low-Risk Investing: Bank accounts are generally considered low-risk investments, making them a great option for conservative investors.

- Flexibility: Many bank accounts offer flexible withdrawal options, allowing you to access your funds when needed.

Cons of Bank Account Interest Rates

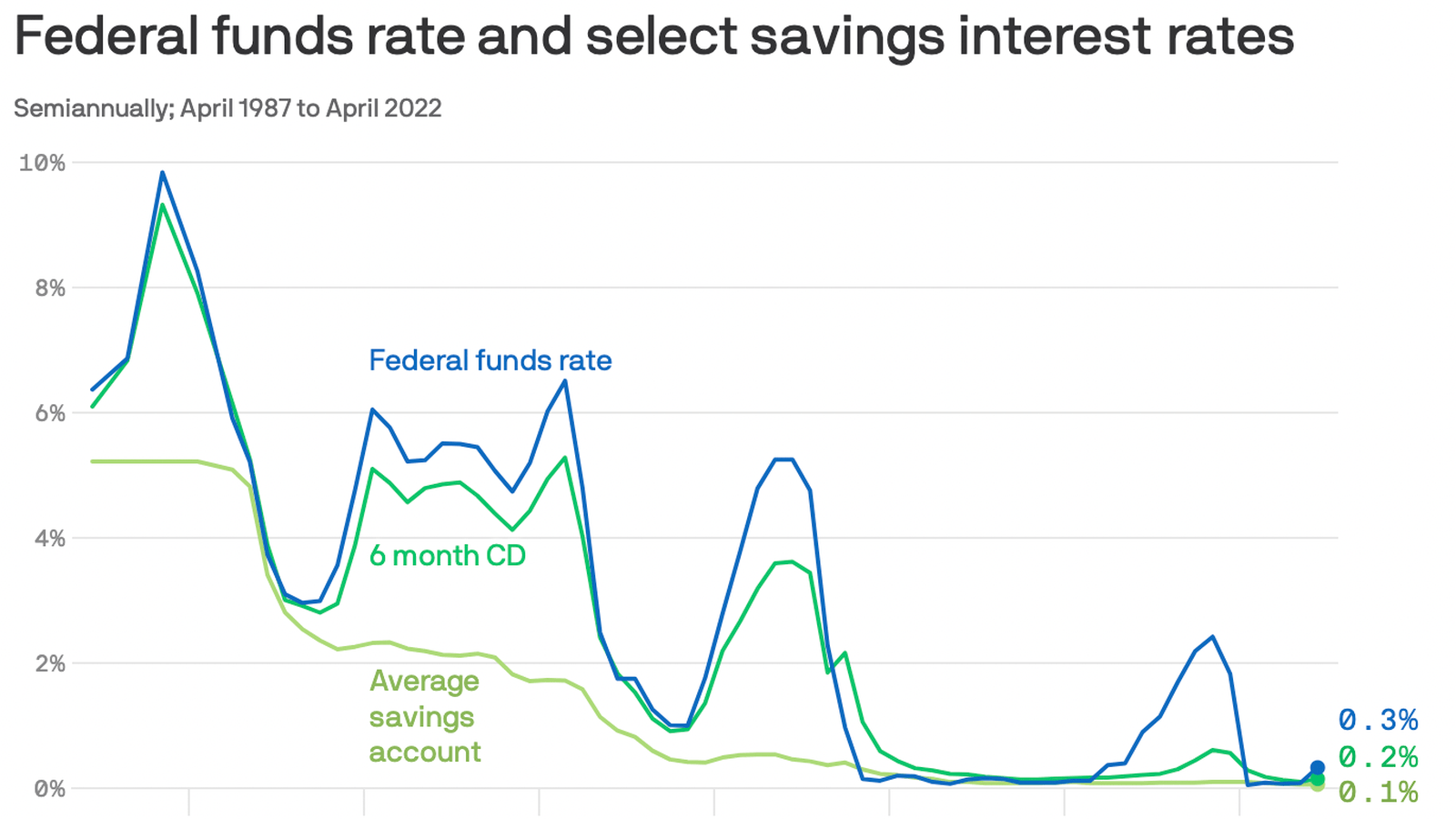

- Low Interest Rates: Historically, bank account interest rates have been low, especially compared to other investment options.

- Inflation Risk: With inflation rates higher than interest rates, the purchasing power of your money may decrease over time.

- Fees and Penalties: Some bank accounts come with fees and penalties for excessive withdrawals, overdrafts, or other activities.

- Minimum Balance Requirements: Some accounts require a minimum balance to avoid fees or earn interest, which can be a challenge for those with limited funds.

Tips for Making the Most of Your Money

- Shop Around: Compare interest rates and terms from multiple banks and credit unions to find the best option for your needs.

- High-Yield Accounts: Consider high-yield accounts, which often offer higher interest rates than traditional accounts.

- Compound Interest: Take advantage of compound interest by leaving your money in the account for an extended period.

- Avoid Fees: Be mindful of fees and penalties, and choose accounts with low or no fees.

- Save and Invest: Combine savings with other investment options, such as stocks or real estate, to diversify your portfolio.

Conclusion

Bank account interest rates may not be the most exciting topic, but they can have a significant impact on your financial well-being. By understanding the pros and cons of bank account interest rates and following our tips, you can make the most of your money and build a stronger financial future. Remember to shop around, take advantage of compound interest, and avoid fees to maximize your earnings.

[ad_2]