Types of Life Insurance

[ad_1]

Types of Life Insurance: A Comprehensive Guide

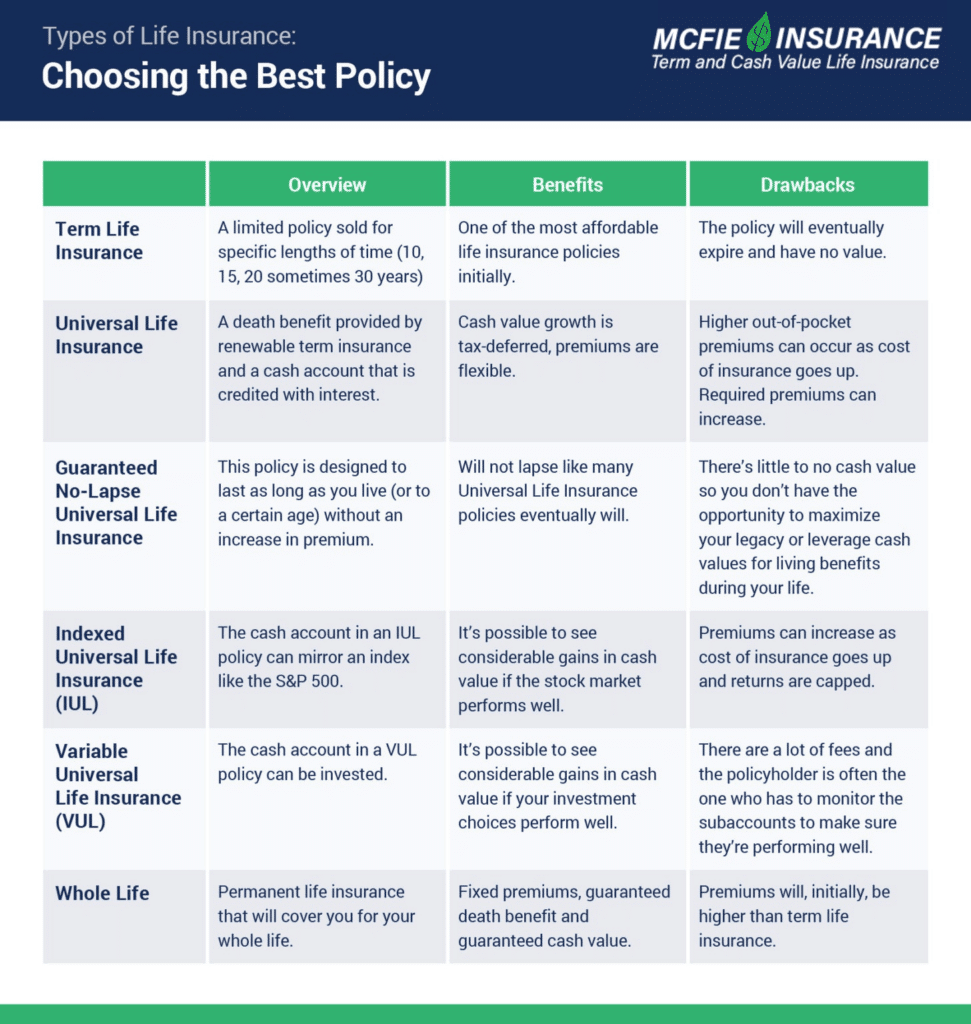

Life insurance is an essential financial tool that provides a sense of security and peace of mind for individuals, families, and businesses. With so many types of life insurance available, it can be overwhelming to navigate the options and choose the right policy for your needs. In this article, we’ll break down the different types of life insurance and help you understand the benefits and features of each.

1. Term Life Insurance

Term life insurance is the most common and simplest type of life insurance. It provides a death benefit to your beneficiaries if you pass away during the term of the policy, usually ranging from 10 to 30 years. If you outlive the term, the policy expires, and you may not receive a refund. Term life insurance is generally more affordable than other types of life insurance, making it a popular choice for young families and individuals.

2. Whole Life Insurance

Whole life insurance, also known as traditional life insurance, provides a death benefit and a cash value component. The cash value component grows over time and can be borrowed against or used to pay premiums. Whole life insurance is more expensive than term life insurance, but it offers a guaranteed death benefit and cash value accumulation.

3. Universal Life Insurance

Universal life insurance is a flexible premium policy that combines a death benefit with a cash value component. You can adjust your premiums, death benefit, and investment options to suit your changing needs. Universal life insurance is ideal for individuals who want flexibility and control over their policy.

4. Variable Life Insurance

Variable life insurance is a type of whole life insurance that allows you to invest your cash value in various investment options, such as mutual funds or stocks. The cash value and death benefit can fluctuate based on the performance of your investments. Variable life insurance is suitable for individuals who want to invest their cash value and potentially earn higher returns.

5. Indexed Universal Life Insurance

Indexed universal life insurance is a type of universal life insurance that earns interest based on the performance of a specific stock market index, such as the S&P 500. The cash value and death benefit can grow more rapidly than traditional universal life insurance, but they may also fluctuate more dramatically.

6. Final Expense Life Insurance

Final expense life insurance, also known as burial insurance, is designed to cover funeral expenses, medical bills, and other final costs. This type of life insurance is typically used to cover the cost of final arrangements, and it’s often more affordable than other types of life insurance.

7. Group Life Insurance

Group life insurance is a type of life insurance that covers multiple individuals, usually employees of a company or members of an organization. The premiums are often lower than individual policies, and the coverage is usually employer-sponsored.

8. Conversion Life Insurance

Conversion life insurance allows you to convert your term life insurance policy to a permanent life insurance policy, such as whole life or universal life insurance. This option is available for a limited time, usually during the first few years of the policy.

Conclusion

Choosing the right type of life insurance can be a complex decision, but understanding the different options can help you make an informed choice. Whether you’re looking for basic protection or more complex coverage, there’s a type of life insurance to suit your needs. By considering your financial goals, budget, and insurance needs, you can select the best life insurance policy to ensure the financial security of your loved ones.

[ad_2]