Why Life Insurance is a Must-Have for Every Family

[ad_1]

Why Life Insurance is a Must-Have for Every Family

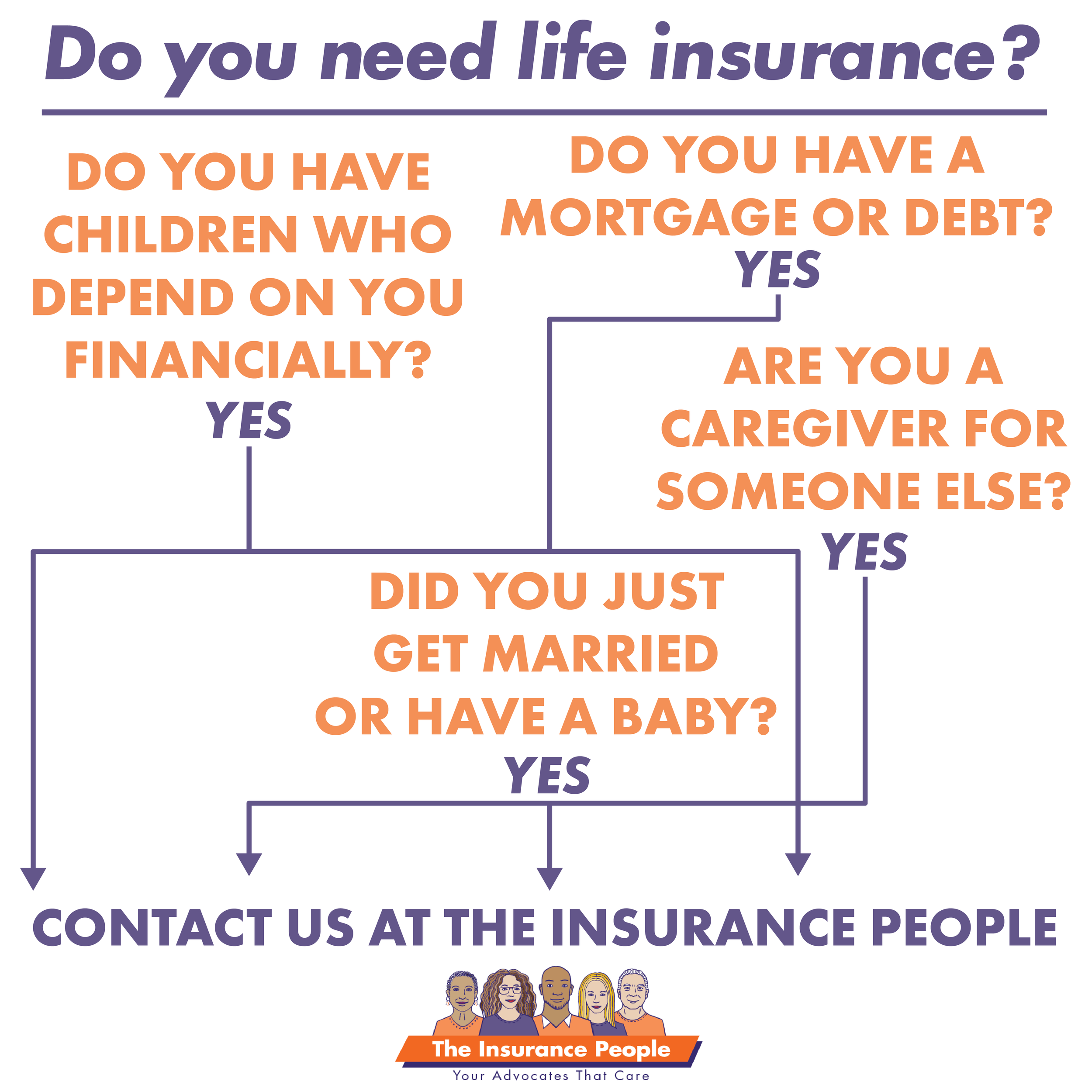

As a parent, one of the most significant concerns is ensuring the financial well-being and security of your loved ones, particularly in the event of your passing. Unfortunately, unexpected events can occur at any time, leaving your family with significant financial burdens. This is where life insurance comes in – a vital component of a comprehensive financial plan that provides peace of mind and protects your family’s financial future.

The Importance of Life Insurance

Life insurance provides a financial safety net for your family in the event of your passing. The proceeds from a life insurance policy can be used to cover final expenses, pay off debts, and provide for your loved ones’ living expenses. This financial protection is especially crucial for families with dependent children, as it ensures that their future is secure, even in the event of the unthinkable.

Benefits of Life Insurance for Families

There are several benefits of having life insurance for every family:

- Income Replacement: Life insurance can replace your income, ensuring that your family can maintain their standard of living even after you’re gone.

- Final Expenses: A life insurance policy can help cover the cost of funeral expenses, medical bills, and other final expenses, alleviating the financial burden on your loved ones.

- Debt Repayment: Life insurance can be used to pay off outstanding debts, such as a mortgage, car loans, and credit cards, giving your family the opportunity to start fresh.

- Long-Term Care: Life insurance can provide a tax-free lump sum payment that can be used to pay for long-term care, such as nursing home expenses, or other health-related costs.

- Business Protection: If you’re a business owner, life insurance can help protect your business partners or heirs by ensuring the continuation of your business operations.

Types of Life Insurance

There are various types of life insurance policies to choose from, including:

- Term Life Insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years) and pays out a death benefit if you pass away during that time.

- Whole Life Insurance: Provides lifelong coverage and a guaranteed death benefit, as well as a cash value component that can be used for other financial needs.

- Universal Life Insurance: A flexible policy that allows you to adjust the premium payments and coverage amount.

How to Choose the Right Life Insurance Policy

When selecting a life insurance policy, consider the following factors:

- Your Family’s Financial Needs: Determine how much money your family will need to maintain their standard of living in the event of your passing.

- Your Age and Health: Consider your age and health status, as these factors can affect the cost of your policy.

- Your Lifestyle: If you have dependents or other financial obligations, you may want to consider a more comprehensive policy.

Conclusion

Life insurance is a crucial component of a comprehensive financial plan for every family. By providing a financial safety net and ensuring that your loved ones are protected, life insurance can give you peace of mind and help your family achieve long-term financial security. When choosing a life insurance policy, consider your family’s financial needs, age, health, and lifestyle to select the right coverage for your loved ones. Don’t wait until it’s too late – get the protection you need today and secure your family’s future tomorrow.

[ad_2]