Why You Should Consider Increasing Your Life Insurance Coverage

Why You Should Consider Increasing Your Life Insurance Coverage

As life goes on, our responsibilities and financial obligations often increase. This can include starting a family, buying a home, and building a career. At the same time, our life insurance coverage may not have kept pace with these changes. In this article, we’ll explore why it’s essential to review your life insurance coverage and consider increasing it to ensure your loved ones are protected in the event of your passing.

Life Insurance: A Safety Net for Your Loved Ones

Life insurance provides a financial safety net for your family in the event of your passing. The policy pays out a death benefit to your beneficiaries, which can be used to cover funeral expenses, outstanding debts, and living expenses. This can help alleviate the financial burden on your loved ones and ensure they can maintain their standard of living.

Why You May Need to Increase Your Life Insurance Coverage

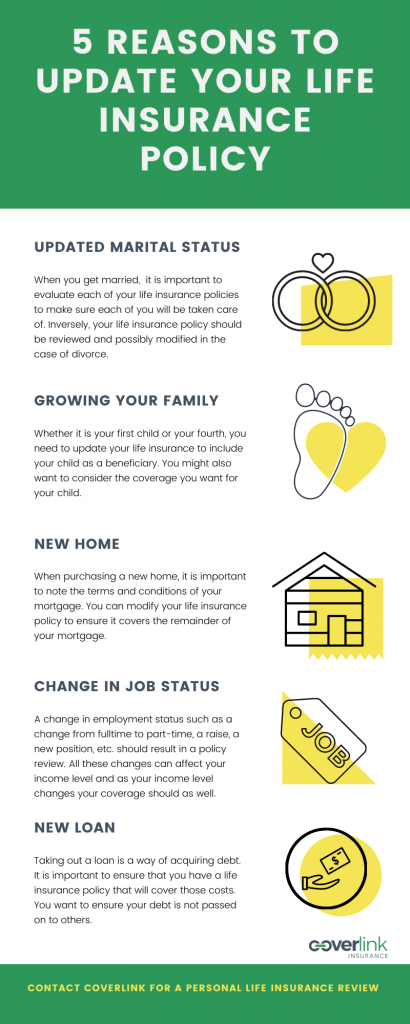

Here are some reasons why you may need to increase your life insurance coverage:

- Growing Family: If you’ve had children, your life insurance coverage may not be sufficient to provide for their future needs. As your family grows, so do their expenses. Increasing your coverage can help ensure your children’s education, healthcare, and living expenses are covered.

- New Financial Obligations: Buying a home, paying off debt, or starting a business can create new financial obligations that may not be covered by your current life insurance policy. Increasing your coverage can help protect your family’s financial security.

- Career Advancement: As your career advances, your income and expenses may increase. This can make it essential to increase your life insurance coverage to ensure your family’s financial well-being.

- Changing Circumstances: Life is unpredictable, and unexpected events can occur. Increasing your life insurance coverage can provide peace of mind knowing your family is protected, no matter what the future holds.

Benefits of Increasing Your Life Insurance Coverage

Increasing your life insurance coverage can have numerous benefits, including:

- Financial Security: Providing for your loved ones’ financial security in the event of your passing.

- Reduced Stress: Knowing your family is protected can reduce stress and anxiety.

- Peace of Mind: Increasing your coverage can give you peace of mind, knowing your family’s financial future is secure.

- Flexibility: Many life insurance policies offer flexible coverage options, allowing you to adjust your coverage as your needs change.

How to Increase Your Life Insurance Coverage

If you’re considering increasing your life insurance coverage, here are some steps to follow:

- Assess Your Needs: Review your current life insurance policy and assess your needs. Consider your family’s financial obligations, expenses, and goals.

- Research Your Options: Research different life insurance policies and coverage options to find the best fit for your needs and budget.

- Consult with a Professional: Consult with a licensed insurance professional to help you determine the right coverage amount and policy type.

- Review and Update: Review and update your policy regularly to ensure it remains aligned with your changing needs.

Conclusion

Increasing your life insurance coverage can provide financial security and peace of mind for your loved ones. As your life circumstances change, it’s essential to review and adjust your coverage to ensure you’re protecting your family’s financial future. By considering your needs, researching your options, and consulting with a professional, you can make informed decisions about your life insurance coverage and ensure your family is protected for years to come.