A Guide to Choosing the Right Bank for Your Needs

A Guide to Choosing the Right Bank for Your Needs

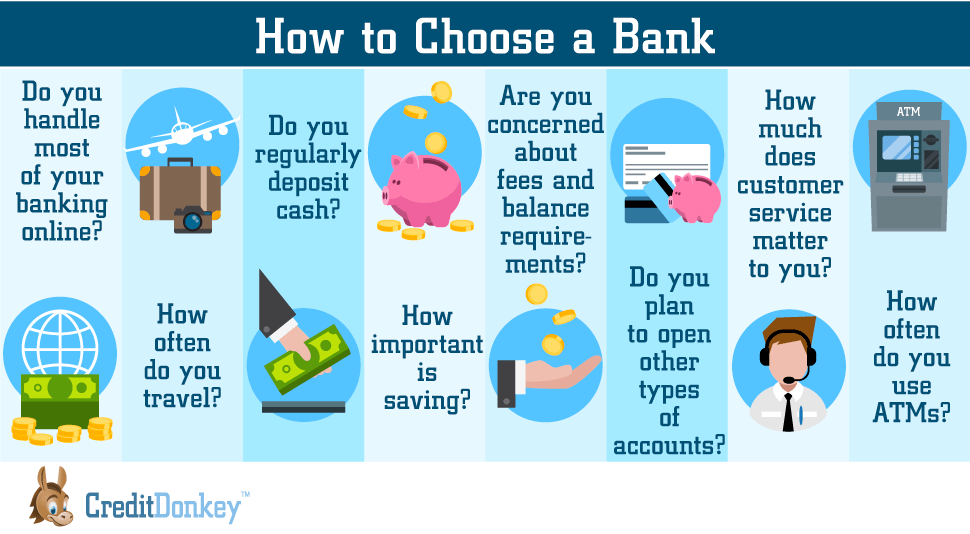

Choosing the right bank is a crucial decision that can have a significant impact on your financial well-being. With numerous banks and financial institutions available, selecting the one that best suits your needs can be overwhelming. In this article, we’ll provide a comprehensive guide to help you make an informed decision and find the perfect bank for you.

Step 1: Define Your Needs

Before starting your search, take some time to identify your financial goals and requirements. Consider the following:

- What type of accounts do you need? (e.g., checking, savings, credit card, loan)

- Do you need online banking and mobile banking services?

- Are you looking for investments, insurance, or other financial services?

- Do you have a specific geographic area in mind (e.g., community bank, national bank)?

- Do you have a preferred bank brand or reputation?

Step 2: Research Bank Options

Once you’ve identified your needs, research potential banks that cater to your requirements. You can:

- Visit the websites of top banks and credit unions to learn more about their products and services

- Read online reviews, ratings, and testimonials from customers and regulatory bodies

- Ask friends, family, and colleagues for recommendations

- Look for banks with a good reputation, stability, and security

Step 3: Evaluate Bank Features

Carefully evaluate the features and services offered by each bank to ensure they align with your needs. Consider the following:

- Fees: Compare fees for services such as checking, ATM withdrawals, and credit card transactions

- Interest rates: If you’re looking for a savings account or loan, compare interest rates and terms

- Service: Consider the bank’s customer service hours, availability, and communication channels

- Technology: Evaluate the bank’s online banking platform, mobile app, and mobile deposit functionality

- Branch and ATM locations: If you prefer to bank in person or need access to ATMs, evaluate the bank’s branch and ATM network

Step 4: Compare Bank Options

Create a table or spreadsheet to compare the features and services of each bank you’ve researched. This will help you visualize your options and make a more informed decision.

Step 5: Visit or Contact the Bank

Once you’ve narrowed down your options, visit or contact the bank to get a sense of their customer service and overall experience. Consider the following:

- Visit a branch or call the bank to ask questions and get a sense of their representatives’ knowledge and friendliness

- Review the bank’s website, mobile app, and online banking platform to see how user-friendly they are

- Contact the bank’s customer service department to test their response time and helpfulness

Conclusion

Choosing the right bank for your needs requires careful research, evaluation, and consideration. By following these steps, you’ll be better equipped to find a bank that meets your financial goals and provides the services you need. Remember to prioritize your needs, research options, evaluate features, compare options, and visit or contact the bank to make an informed decision. With the right bank, you can ensure your financial well-being and achieve your goals.