The Benefits of Permanent Life Insurance: Whole, Universal, and Variable

The Benefits of Permanent Life Insurance: Whole, Universal, and Variable

When it comes to life insurance, many people are familiar with term life insurance, which provides coverage for a set period of time (e.g., 10, 20, or 30 years). However, there is another type of life insurance that offers permanent coverage for the policyholder’s entire lifetime: permanent life insurance. This type of insurance provides a death benefit and a cash value component, which can be used to meet a variety of financial goals.

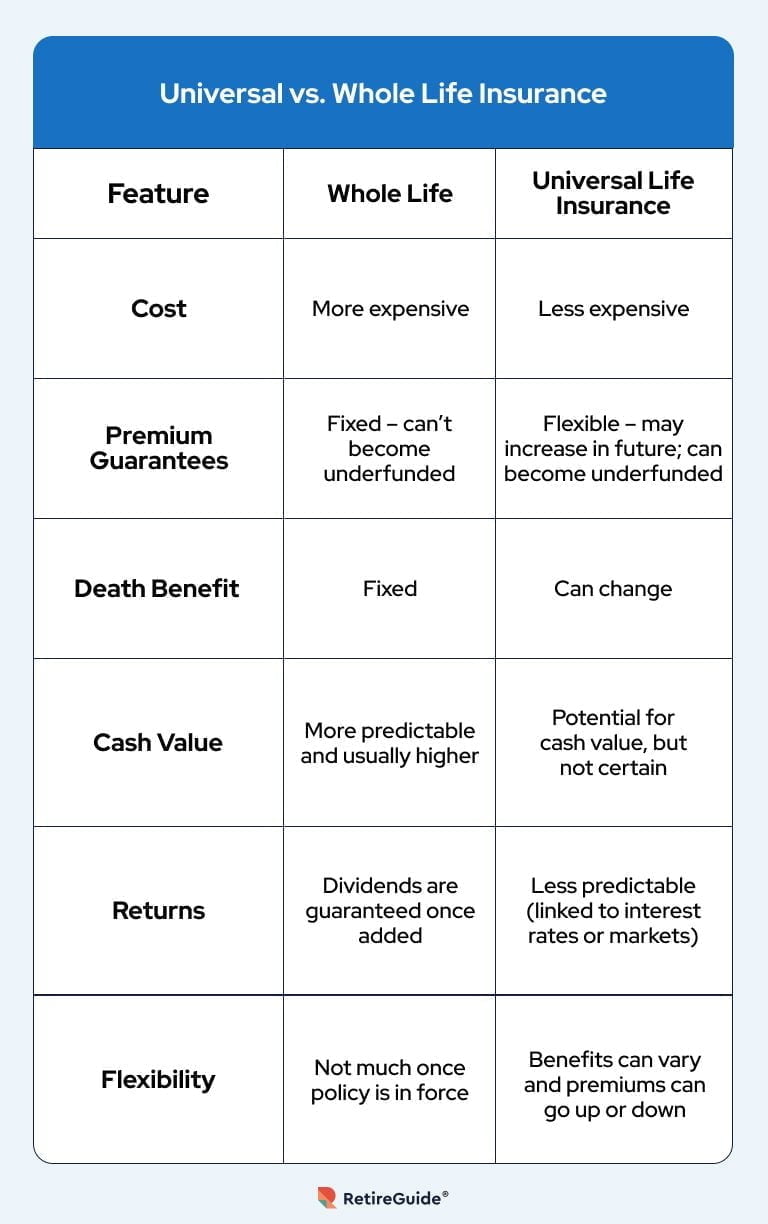

There are three main types of permanent life insurance: whole life, universal life, and variable life. Each has its own unique features and benefits, but they all share the common goal of providing lifetime coverage and a cash value component.

Whole Life Insurance

Whole life insurance, also known as traditional life insurance, is the most straightforward type of permanent life insurance. It provides a death benefit and a fixed cash value component that grows over time. The premiums are typically level and remain the same throughout the policy term. Whole life insurance is often used to cover final expenses, such as funeral costs and outstanding debts.

The benefits of whole life insurance include:

- Lifetime coverage: Whole life insurance provides coverage for the policyholder’s entire lifetime.

- Fixed premiums: The premiums are typically level and remain the same throughout the policy term.

- Cash value component: The policy builds a cash value over time, which can be borrowed against or used to pay premiums.

- Guaranteed death benefit: The death benefit is guaranteed, and the policyholder’s beneficiaries will receive the death benefit regardless of the policy’s cash value.

Universal Life Insurance

Universal life insurance is a flexible premium policy that combines a death benefit with a cash value component. The cash value grows at a variable rate, and the policyholder can adjust the premium payments, death benefit, and investment options. Universal life insurance is often used by individuals who want to build wealth over time and have flexibility in their policy.

The benefits of universal life insurance include:

- Flexibility: Policyholders can adjust the premium payments, death benefit, and investment options.

- Tax-deferred growth: The cash value grows tax-deferred, which means the policyholder won’t have to pay taxes on the gains until they withdraw the funds.

- Investment options: Policyholders can choose from a variety of investment options, such as mutual funds or index funds.

- Adjustable premiums: Policyholders can adjust the premium payments to suit their changing financial situation.

Variable Life Insurance

Variable life insurance is another type of permanent life insurance that combines a death benefit with a cash value component. The cash value grows at a variable rate, and the policyholder can invest the cash value in a variety of investments, such as mutual funds or stocks. Variable life insurance is often used by individuals who want to build wealth over time and have control over their investments.

The benefits of variable life insurance include:

- Investment options: Policyholders can invest the cash value in a variety of investments, such as mutual funds or stocks.

- Tax-deferred growth: The cash value grows tax-deferred, which means the policyholder won’t have to pay taxes on the gains until they withdraw the funds.

- Flexibility: Policyholders can adjust the premium payments and investment options to suit their changing financial situation.

- Potential for higher returns: Variable life insurance offers the potential for higher returns than other types of life insurance, but also comes with greater risk.

Conclusion

Permanent life insurance, including whole, universal, and variable life insurance, offers a range of benefits that can help individuals achieve their financial goals. Whether you’re looking to cover final expenses, build wealth over time, or have flexibility in your policy, there is a type of permanent life insurance that may be right for you. It’s essential to consult with a licensed insurance professional to determine the best type of life insurance for your individual circumstances.