Life Insurance for Seniors: Options and Considerations

Life Insurance for Seniors: Options and Considerations

As we age, our needs and priorities change, and one important consideration is ensuring that our loved ones are protected financially in the event of our passing. Life insurance for seniors can provide a safety net for those who depend on us, even if we’re no longer around. However, the options and considerations for seniors can be complex and overwhelming. In this article, we’ll explore the different types of life insurance available to seniors, as well as factors to consider when making a decision.

Types of Life Insurance for Seniors

There are several types of life insurance that may be suitable for seniors, including:

- Term Life Insurance: This type of insurance provides coverage for a specific period (e.g., 10, 20, or 30 years) and pays out a death benefit if the insured person passes away during that term.

- Whole Life Insurance: Also known as permanent life insurance, whole life insurance provides lifelong coverage and a cash value component that grows over time.

- Final Expense Insurance: This type of insurance is designed to cover funeral expenses, medical bills, and other final costs, with a relatively low death benefit (typically between $5,000 and $25,000).

- Guaranteed Issue Life Insurance: This type of insurance is available to seniors with pre-existing medical conditions and provides coverage with no medical exam or health questions.

- Simplified Issue Life Insurance: This type of insurance is similar to guaranteed issue, but may require a brief medical exam or health questionnaire.

Factors to Consider

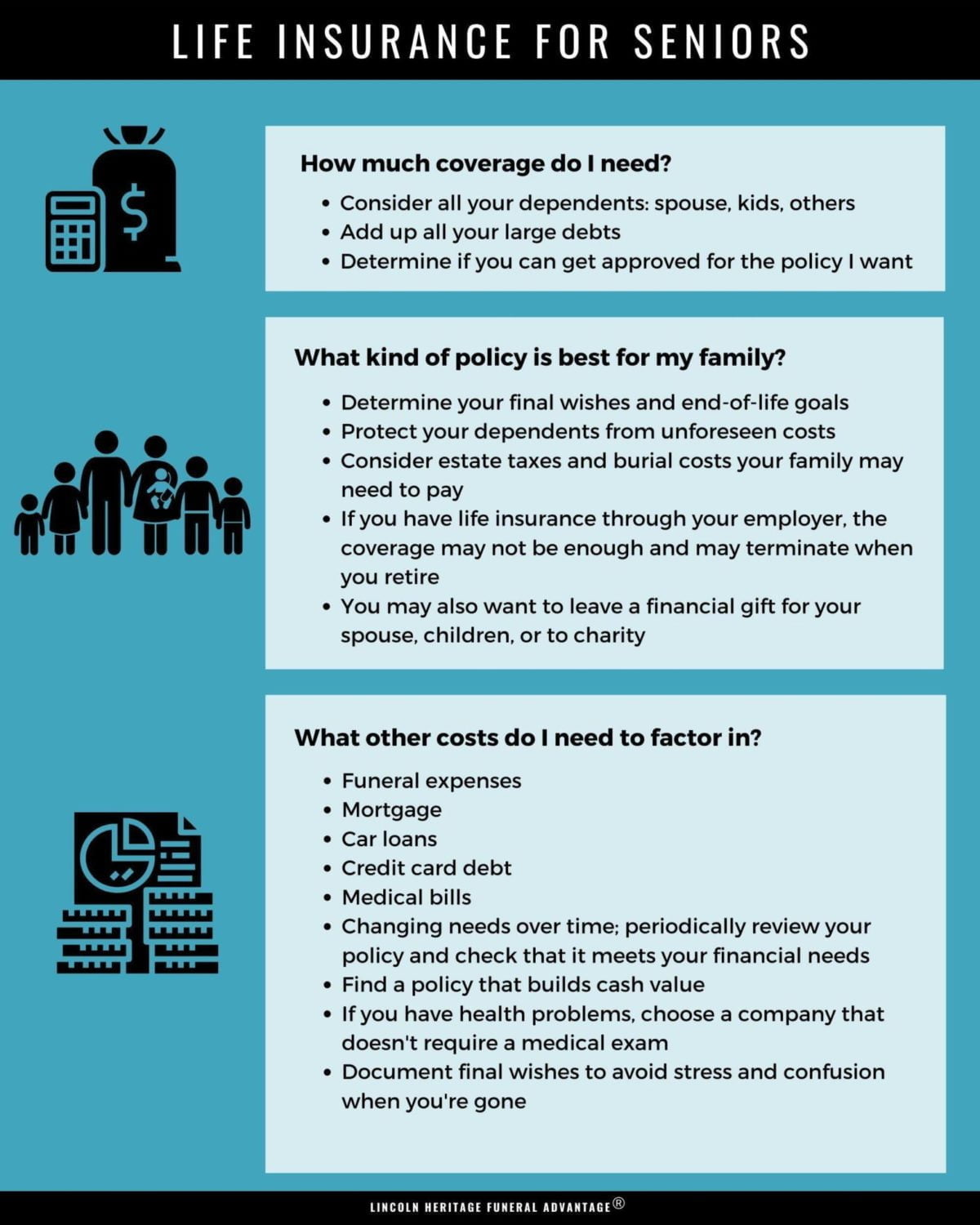

When shopping for life insurance as a senior, there are several factors to consider:

- Health: As we age, our health can decline, making it more challenging to qualify for life insurance or increasing the premium costs.

- Age: The older you are, the higher your premiums will likely be, as the insurance company assumes you’re closer to passing away.

- Income: If you have a limited income, you may need to consider a less expensive option or shop around for a better rate.

- Finances: Your financial situation can impact your ability to pay premiums, so consider your budget when selecting a policy.

- Coverage needs: Determine how much coverage you need to ensure your loved ones are protected financially.

Tips for Seniors

When shopping for life insurance as a senior, here are some additional tips to keep in mind:

- Compare rates: Shop around and compare rates from different insurance companies to find the best deal.

- Consider a living benefits rider: This rider can provide a death benefit while you’re still alive, if you’re diagnosed with a terminal illness.

- Look for a no-lapse guarantee: This feature ensures that your policy will remain in force, even if your premiums are increased or you miss a payment.

- Consult with a professional: A licensed insurance agent or financial advisor can help you navigate the process and find the best policy for your needs.

- Review and update: Regularly review your policy to ensure it’s still meeting your needs and update your beneficiary information as necessary.

Conclusion

Life insurance for seniors can provide peace of mind and financial protection for loved ones. By understanding the different types of life insurance available and considering factors such as health, age, income, finances, and coverage needs, seniors can make an informed decision about the best policy for their situation. Remember to compare rates, consider riders and guarantees, and consult with a professional to ensure you’re getting the right coverage.