The Role of Life Insurance in Retirement Planning

The Role of Life Insurance in Retirement Planning

When it comes to retirement planning, many individuals focus on saving for income, healthcare, and other expenses. However, one often overlooked aspect of retirement planning is the role of life insurance. While life insurance may not be the first thing that comes to mind when thinking about retirement, it can play a crucial role in ensuring a secure and comfortable retirement.

Why Life Insurance in Retirement Planning?

In retirement, the need for life insurance may seem less pressing. After all, you’re no longer working and earning an income. However, life insurance can still provide valuable benefits in retirement, including:

- Income Replacement: If you have a spouse or dependents, life insurance can provide a tax-free income stream to help replace your income in the event of your passing.

- Estate Planning: Life insurance can be used to fund an estate plan, ensuring that your loved ones are taken care of after you’re gone.

- Long-Term Care: Life insurance can be used to pay for long-term care expenses, such as nursing home care or home health care.

- Business Succession: If you own a business, life insurance can be used to fund a buy-sell agreement, ensuring that your business is transferred to the next generation or sold to a third party.

Types of Life Insurance for Retirement Planning

There are several types of life insurance that can be used in retirement planning, including:

- Term Life Insurance: Term life insurance provides coverage for a specific period of time (e.g., 10, 20, or 30 years). It’s often less expensive than permanent life insurance and can be used to cover a specific period of time in retirement.

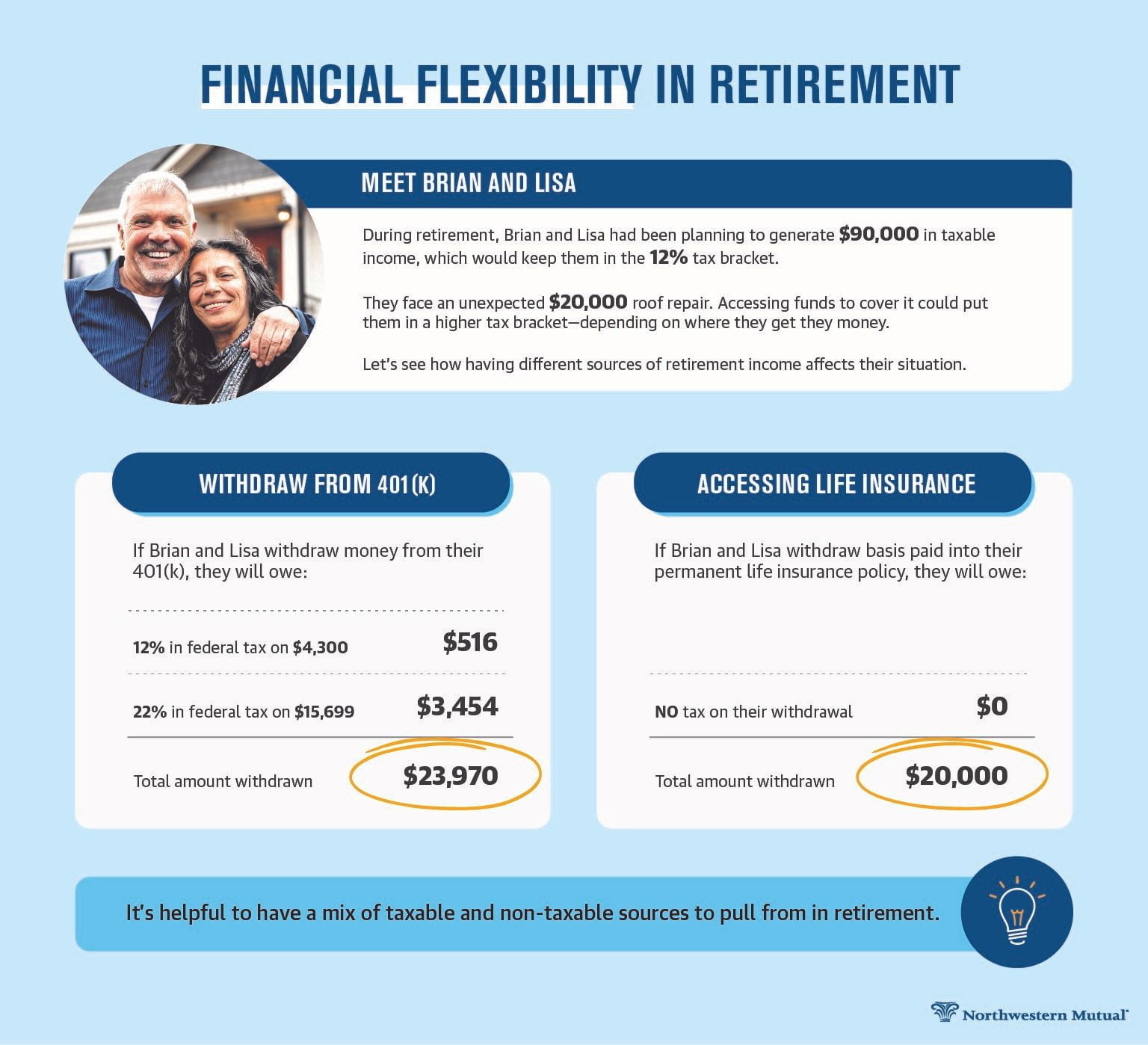

- Permanent Life Insurance: Permanent life insurance, such as whole life or universal life insurance, provides lifetime coverage and a cash value component that can be used to supplement retirement income.

- Final Expense Life Insurance: Final expense life insurance is designed to cover funeral expenses, medical bills, and other final expenses.

How to Incorporate Life Insurance into Your Retirement Plan

Incorporating life insurance into your retirement plan requires careful consideration of your individual circumstances and goals. Here are some steps to follow:

- Assess Your Needs: Determine your need for life insurance in retirement, including the need for income replacement, estate planning, and long-term care.

- Choose the Right Policy: Select a life insurance policy that meets your needs and budget, such as term life insurance or permanent life insurance.

- Consider a Conversion Option: If you have a term life insurance policy, consider converting it to a permanent life insurance policy in retirement to ensure lifetime coverage.

- Review and Update: Review and update your life insurance policy regularly to ensure it remains aligned with your changing needs and circumstances.

Conclusion

Life insurance is an often overlooked aspect of retirement planning, but it can play a crucial role in ensuring a secure and comfortable retirement. By understanding the different types of life insurance and how they can be used in retirement planning, individuals can make informed decisions about their insurance needs and create a comprehensive retirement plan.